Are you ready to take control of your financial future and build lasting wealth? This comprehensive guide, “The Fundamentals of Wealth Management,” will equip you with the essential knowledge and strategies to achieve your financial goals. We’ll explore key concepts such as budgeting, investing, risk management, estate planning, and tax optimization, providing you with a practical framework for growing your wealth and securing your financial well-being. Learn how to make informed decisions, build a diversified portfolio, and navigate the complexities of financial planning to achieve long-term financial success.

What is Wealth Management?

Wealth management is a comprehensive financial planning process designed to help individuals and families grow, protect, and preserve their assets. It goes beyond simple investment management, encompassing a holistic approach to financial well-being.

This involves a wide range of services, including investment strategies, tax planning, estate planning, retirement planning, and risk management. The goal is to create a personalized financial plan tailored to an individual’s unique circumstances, goals, and risk tolerance.

Financial advisors play a crucial role in wealth management, providing expert guidance and support to clients throughout the process. They help individuals navigate complex financial decisions, make informed choices, and achieve their long-term financial objectives.

Creating a Long-Term Wealth Plan

Creating a robust long-term wealth plan requires a comprehensive approach encompassing several key elements. First, you need to define your financial goals, both short-term and long-term. This includes identifying specific targets like retirement, education funding, or purchasing a property.

Next, you should assess your current financial situation. This involves analyzing your income, expenses, assets, and liabilities to understand your net worth and spending habits. This clarity is crucial for making informed decisions.

A crucial step is budgeting and saving. Developing a realistic budget helps allocate resources effectively toward your goals. Consistent saving, even small amounts, is essential for wealth accumulation. Consider the power of compound interest over the long term.

Investing is key to long-term wealth growth. Diversifying your investments across different asset classes, like stocks, bonds, and real estate, can mitigate risk and optimize returns. Your investment strategy should align with your risk tolerance and time horizon.

Regularly review and adjust your plan. Life circumstances change, and your financial plan should adapt accordingly. Periodic reviews ensure your strategy remains aligned with your evolving goals and market conditions. Seeking professional financial advice can greatly enhance your planning process.

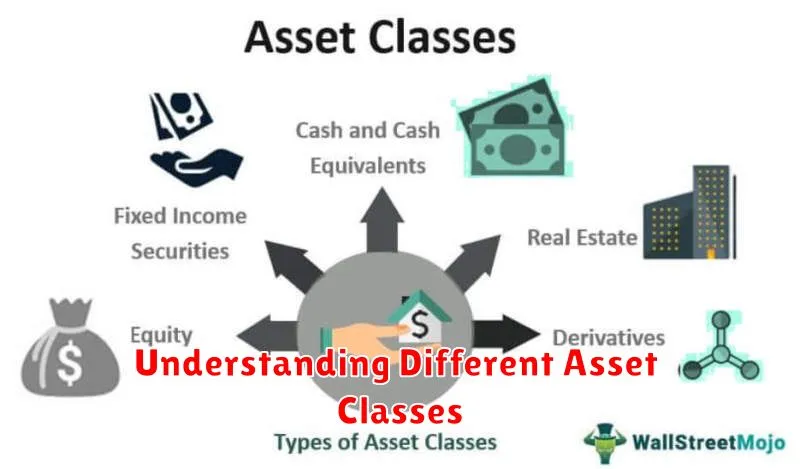

Understanding Different Asset Classes

Understanding different asset classes is crucial for effective wealth management. Asset classes represent groupings of investments with similar characteristics, risk profiles, and return expectations. Diversification across asset classes is a cornerstone of sound investment strategy.

Equities (Stocks) represent ownership in a company and offer potential for high growth but also carry higher risk. Returns are driven by company performance and market sentiment.

Fixed Income (Bonds) are debt instruments representing a loan to a company or government. They generally offer lower returns than equities but with less risk, providing stability to a portfolio. Interest rates significantly impact bond values.

Real Estate involves investing in properties, offering potential for rental income and capital appreciation. It’s often considered a less liquid asset class, with values influenced by location, market conditions, and economic factors.

Alternative Investments encompass a wide range of assets, including private equity, hedge funds, commodities, and precious metals. These options often carry higher risks and illiquidity but may provide diversification and potential for higher returns.

Cash and Cash Equivalents are highly liquid assets such as savings accounts and money market funds. They offer minimal returns but provide stability and easy access to funds.

The optimal allocation across these asset classes depends on individual risk tolerance, investment goals, and time horizon. Professional financial advice can help determine the most suitable asset allocation strategy for your specific circumstances.

The Importance of Estate Planning

Estate planning is a crucial component of comprehensive wealth management. It involves the strategic planning and management of your assets and their distribution after your death or incapacitation. Failing to plan can lead to unintended consequences, including lengthy and costly probate processes, family disputes, and inefficient distribution of assets.

Proper estate planning ensures that your wishes regarding the distribution of your assets are followed. This includes specifying beneficiaries for your accounts, designating guardians for minor children, and establishing trusts to manage assets for the benefit of loved ones. It also allows for the efficient transfer of assets, minimizing tax burdens and legal complications.

Beyond financial assets, estate planning addresses important legal and healthcare decisions. It allows you to designate a healthcare proxy to make decisions on your behalf if you become incapacitated and to establish an advance directive outlining your end-of-life wishes. This provides peace of mind for you and your family during challenging times.

In summary, effective estate planning protects your assets, safeguards your family’s future, and ensures your wishes are respected. It’s an essential element of securing your legacy and a fundamental part of responsible wealth management.

Wealth Preservation Strategies

Wealth preservation involves safeguarding and growing your assets over time to maintain your financial well-being. Diversification is crucial; spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces risk. Strategic asset allocation, tailoring your portfolio to your risk tolerance and financial goals, is equally important.

Tax efficiency is paramount. Employing strategies like tax-advantaged accounts (401(k)s, IRAs) and tax-loss harvesting minimizes your tax burden and maximizes your returns. Careful estate planning, including the creation of a will and trusts, ensures assets are distributed according to your wishes and minimizes estate taxes.

Inflation hedging is essential for protecting your purchasing power. Investing in assets that tend to appreciate with inflation, such as real estate or commodities, can help mitigate the erosion of wealth. Regularly rebalancing your portfolio ensures your asset allocation remains aligned with your goals, even as market conditions change.

Finally, professional guidance is invaluable. Consulting with a qualified financial advisor can provide personalized strategies tailored to your specific circumstances, ensuring long-term wealth preservation.

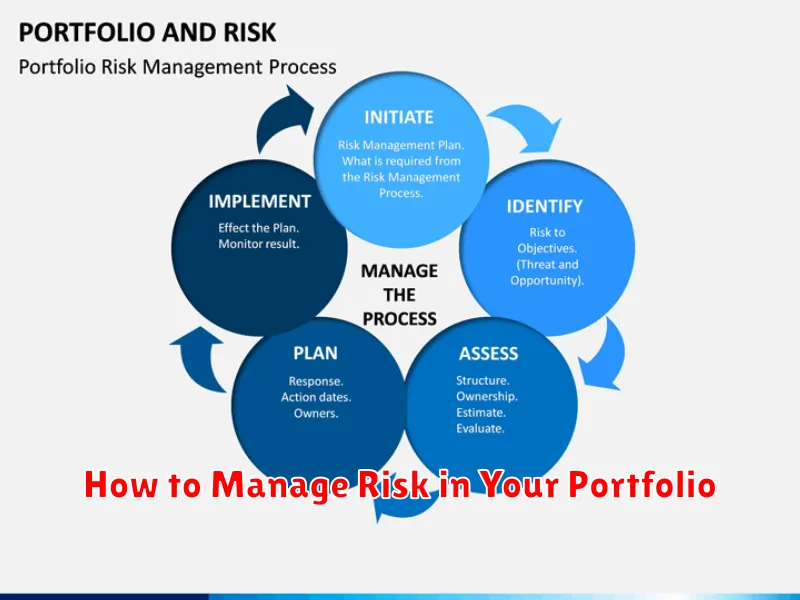

How to Manage Risk in Your Portfolio

Effective portfolio management hinges on understanding and mitigating risk. A well-diversified portfolio is the cornerstone of risk management. This involves spreading investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of any single investment’s underperformance.

Diversification is not the only strategy; understanding your own risk tolerance is crucial. This involves assessing your comfort level with potential losses and aligning your investments accordingly. A younger investor with a longer time horizon might tolerate more risk, while an older investor closer to retirement may prioritize capital preservation.

Regular rebalancing is essential. As market conditions change, the asset allocation of your portfolio may drift from your target. Rebalancing involves selling some assets that have outperformed and buying others that have underperformed, bringing your portfolio back to its original allocation. This helps to capitalize on market fluctuations and manage risk effectively.

Finally, consider seeking professional advice. A financial advisor can help you develop a personalized investment strategy tailored to your specific risk tolerance, financial goals, and time horizon. They can provide valuable insights and guidance to navigate the complexities of investing and effectively manage risk in your portfolio.

Tax-Efficient Investment Strategies

Tax-efficient investing involves structuring investments to minimize your tax liability, maximizing returns after taxes. This is crucial for long-term wealth building.

Tax-advantaged accounts like 401(k)s and IRAs offer significant tax benefits, allowing contributions to grow tax-deferred or tax-free. Understanding contribution limits and withdrawal rules is vital.

Diversification across various asset classes can help reduce your overall tax burden. For example, combining tax-advantaged investments with taxable accounts can strategically manage capital gains and income taxes.

Tax-loss harvesting involves selling losing investments to offset capital gains, reducing your overall tax bill. This requires careful planning and consideration of wash-sale rules.

Municipal bonds generally offer tax-exempt interest income, making them an attractive option for high-income earners seeking to reduce their taxable income. However, they typically offer lower yields compared to taxable bonds.

Consult with a financial advisor to develop a comprehensive tax-efficient investment strategy tailored to your individual circumstances and financial goals. Professional guidance ensures you leverage all available tax benefits optimally.

The Role of a Financial Advisor

A financial advisor plays a crucial role in the wealth management process. They act as a trusted guide, helping individuals and families navigate complex financial decisions and achieve their long-term financial goals.

Their responsibilities encompass a wide range of services, including financial planning, investment management, retirement planning, tax planning, and estate planning. They analyze an individual’s current financial situation, assess their risk tolerance, and develop a personalized strategy to maximize wealth.

Financial advisors provide valuable expertise and objective advice, helping clients make informed decisions about investments, debt management, and insurance. They also monitor market conditions and adjust strategies as needed to ensure clients remain on track to achieve their objectives. Essentially, they act as a central point of contact for all financial matters, simplifying a complex process and providing peace of mind.

Planning for Generational Wealth

Planning for generational wealth involves strategically managing assets to ensure financial security not only for yourself but also for future generations. This requires a long-term perspective and a proactive approach to investment, estate planning, and wealth preservation.

Key strategies include diversifying your investment portfolio across various asset classes, minimizing taxes through appropriate planning, and establishing clear communication with family members regarding financial goals and responsibilities. A crucial element is creating a robust estate plan, which encompasses wills, trusts, and power of attorney documents to ensure the smooth transfer of assets and minimize potential disputes.

Furthermore, education is paramount. Teaching future generations about responsible financial management, including budgeting, saving, investing, and debt management, empowers them to build upon the legacy you create. Regular family meetings to discuss financial matters and goals can foster open communication and understanding.

Finally, professional guidance from financial advisors and estate planning attorneys is highly recommended. They can provide personalized advice tailored to your unique circumstances and help you navigate the complexities of wealth management and transfer. Remember, building generational wealth is a collaborative effort that requires careful planning, consistent execution, and ongoing adaptation to changing circumstances.