Are you looking for effective ways to reduce your tax burden and maximize your after-tax income? This article outlines essential tax strategies that can significantly lower your tax liability. We’ll explore various methods, including tax deductions, credits, and planning techniques, to help you legally minimize your tax payments and keep more of your hard-earned money. Learn how to optimize your tax situation and achieve significant tax savings with our expert advice.

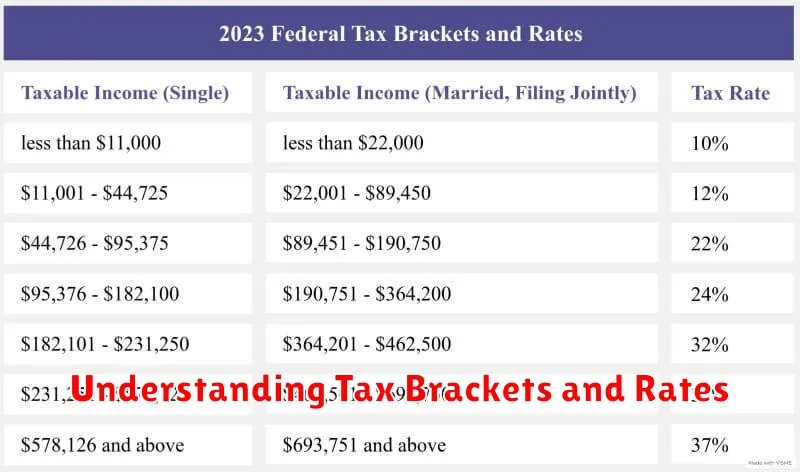

Understanding Tax Brackets and Rates

Understanding tax brackets and rates is crucial for effective tax planning. Tax brackets are income ranges, each subject to a different tax rate. Your taxable income determines which bracket you fall into. It’s important to note that you don’t pay the highest rate on your entire income; only the portion of your income within that specific bracket is taxed at that higher rate. For example, if your income falls into the 22% bracket, only the income exceeding the lower bracket’s threshold will be taxed at 22%. The income below that threshold remains taxed at the lower rates of the preceding bracket(s).

Tax rates are the percentages applied to income within each bracket. These rates are progressive, meaning higher earners pay a larger percentage of their income in taxes. Knowing your bracket and the applicable rates allows you to estimate your tax liability and strategize to potentially minimize your tax burden. The specific brackets and rates vary based on filing status (single, married filing jointly, etc.) and are subject to change annually.

Careful tax planning considers these brackets and rates. Strategies like maximizing deductions and credits can help reduce your taxable income, thus placing you in a lower bracket or lowering the overall tax owed within your current bracket. Consulting with a tax professional can provide personalized guidance on optimizing your tax situation.

How to Legally Reduce Your Taxable Income

Reducing your taxable income legally involves strategically utilizing deductions and credits offered by the tax code. Careful planning is key.

One effective method is maximizing deductible expenses. This includes contributions to retirement accounts (like 401(k)s and IRAs), eligible healthcare costs, and itemized deductions if they exceed the standard deduction. Accurately tracking and documenting these expenses is crucial.

Another strategy involves exploring available tax credits. These directly reduce your tax liability, offering a more impactful reduction than deductions. Research credits for education, childcare, or energy efficiency improvements to see if you qualify.

Tax-loss harvesting, selling investments that have lost value to offset capital gains, can also lower your taxable income. However, it requires understanding the rules and potential implications.

Finally, consulting with a qualified tax professional is highly recommended. They can provide personalized advice based on your specific financial situation and help you navigate the complexities of tax law to ensure you’re taking full advantage of all available legal deductions and credits.

Tax-Efficient Investment Strategies

Strategic investment choices can significantly reduce your overall tax burden. Tax-advantaged accounts, such as 401(k)s and IRAs, offer significant tax benefits by either deferring or eliminating taxes on investment growth. Contributing to these accounts reduces your current taxable income and allows your investments to grow tax-free until withdrawal.

Municipal bonds generally offer tax-exempt interest income, making them attractive for investors in higher tax brackets. Dividend-paying stocks can offer tax advantages depending on your holding period and the type of dividend. Qualified dividends often receive a lower tax rate than ordinary income.

Tax-loss harvesting involves selling losing investments to offset capital gains, thereby reducing your capital gains tax liability. This strategy requires careful planning and consideration of the wash-sale rule.

Real estate investment trusts (REITs) can offer tax benefits as they are required to distribute a significant portion of their income as dividends, often qualifying for the lower dividend tax rate. However, it’s crucial to understand the specific tax implications of REIT investments.

It’s essential to consult with a qualified financial advisor and tax professional to determine the most appropriate tax-efficient investment strategies based on your individual financial situation and goals. Proper planning is key to minimizing your tax liability while maximizing your investment returns.

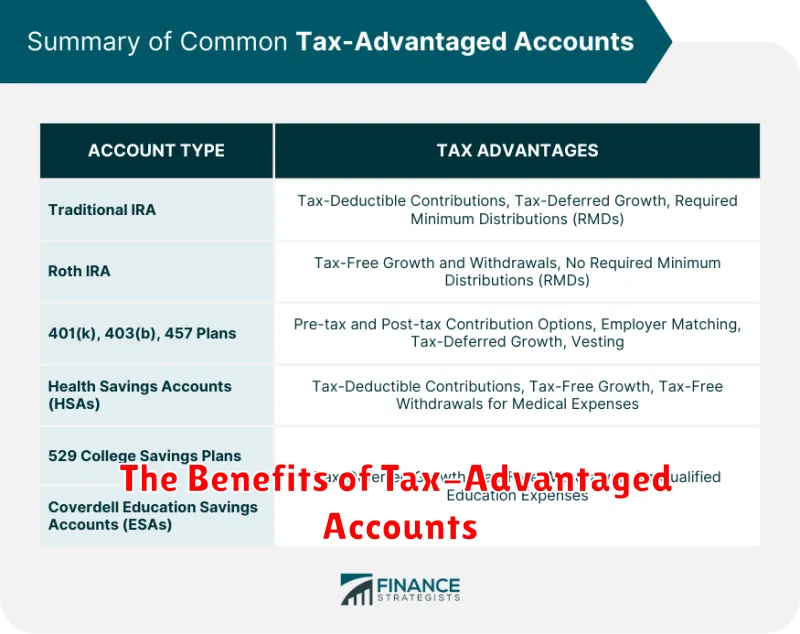

The Benefits of Tax-Advantaged Accounts

Tax-advantaged accounts offer significant benefits for reducing your overall tax burden. These accounts allow you to either reduce your current taxable income or defer taxes until retirement, leading to substantial long-term savings.

Reduced Taxable Income: Contributions to accounts like traditional 401(k)s and traditional IRAs are often tax-deductible, directly lowering your taxable income in the present year. This results in a lower tax bill immediately.

Tax-Deferred Growth: Investments within tax-advantaged accounts like Roth IRAs and Roth 401(k)s grow tax-free. While you pay taxes on contributions upfront, your earnings are not taxed when withdrawn in retirement, resulting in a larger nest egg.

Lower Tax Rates in Retirement: For those anticipating a lower tax bracket in retirement, utilizing traditional retirement accounts can be advantageous. You’ll pay taxes on withdrawals in retirement, but potentially at a lower rate than your current income bracket.

Strategic Account Selection: Choosing the right tax-advantaged account depends on your individual financial situation and tax projections. Careful consideration of your current and anticipated future tax brackets is crucial in maximizing the benefits of these accounts.

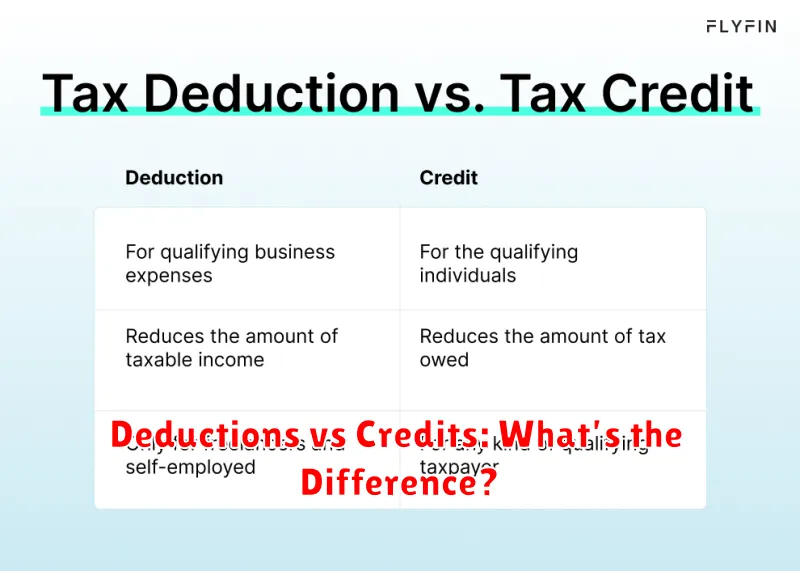

Deductions vs Credits: What’s the Difference?

Both deductions and credits reduce your tax liability, but they do so in different ways. A deduction lowers your taxable income, resulting in a smaller tax bill. For example, if your taxable income is $50,000 and you have a $5,000 deduction, your taxable income becomes $45,000.

A tax credit, on the other hand, directly reduces the amount of tax you owe. A $5,000 tax credit directly subtracts $5,000 from your tax liability. This makes credits generally more valuable than deductions, as a dollar of credit reduces your tax bill by a dollar, while a dollar of deduction reduces your tax bill by a smaller amount (depending on your tax bracket).

To illustrate, consider a taxpayer in the 22% tax bracket. A $1,000 deduction would reduce their tax liability by $220 (22% of $1,000), whereas a $1,000 credit would reduce their tax liability by $1,000. Therefore, understanding the difference between deductions and credits is crucial for maximizing your tax savings.

How to Minimize Capital Gains Taxes

Capital gains taxes can significantly impact your overall tax liability. Minimizing this burden requires strategic planning. One key strategy is to understand the different capital gains tax rates. These rates vary depending on your income level and the holding period of the asset.

Tax-loss harvesting is another effective method. This involves selling losing investments to offset gains, reducing your taxable income. However, be mindful of the wash-sale rule, which prevents you from immediately repurchasing a substantially identical security.

Gifting appreciated assets to loved ones can also help minimize capital gains taxes. While the recipient may eventually pay taxes on the assets, the transfer may allow you to avoid paying taxes entirely on the appreciated value during your lifetime. Consult a tax advisor regarding annual gift tax exclusions.

Strategic asset allocation can also play a role. Diversifying your portfolio across different asset classes can help mitigate potential capital gains taxes in the future by smoothing out gains and losses over time.

Finally, consulting with a qualified tax professional is crucial. They can help you create a personalized tax strategy based on your specific financial situation, taking into account your income, assets, and investment goals to help you legally minimize your capital gains tax burden.

Tax Planning for Self-Employed Individuals

Self-employment offers flexibility, but it also brings unique tax responsibilities. Effective tax planning is crucial for minimizing your tax burden and maximizing your income.

One key strategy is to maximize deductible business expenses. This includes costs associated with your home office, supplies, travel, and professional development. Meticulously track all expenses and maintain organized records.

Retirement planning is another important aspect. Contributions to self-employed retirement plans, such as SEP IRAs or solo 401(k)s, are tax-deductible, lowering your taxable income. Explore the options available to find the best fit for your situation.

Understanding tax deductions and credits specific to self-employed individuals is essential. Research available credits for healthcare expenses or childcare costs that might apply to your circumstances.

Regularly consult with a tax professional. They can provide personalized guidance based on your specific income, expenses, and financial goals. Proactive tax planning throughout the year is far more effective than reacting to tax obligations at the end of the year.

Accurate record-keeping is paramount. Maintain detailed and organized records of all income and expenses to ensure accurate tax filing and avoid potential audits.

The Importance of Keeping Good Financial Records

Maintaining meticulous financial records is paramount for effective tax planning and minimizing your tax liability. Accurate records provide the necessary documentation to support deductions and credits, allowing you to legally reduce your taxable income.

Organized records simplify the tax preparation process, reducing the time and stress associated with filing. This allows for a more thorough review of your financial situation, potentially revealing additional tax-saving opportunities.

In the event of an audit, well-maintained records serve as crucial evidence to support your tax return, protecting you from potential penalties and interest charges. Without them, resolving discrepancies becomes significantly more difficult.

Beyond tax benefits, good financial records offer valuable insights into your overall financial health, enabling informed decision-making regarding investments, spending, and future financial planning.

Common Tax Mistakes to Avoid

Failing to keep accurate records is a major mistake. Maintain detailed records of all income and expenses to support your tax return. Organize documents by category (e.g., business expenses, charitable donations) for easy access during tax season.

Many taxpayers underestimate or overlook deductions. Familiarize yourself with available deductions and credits, such as those for charitable contributions, home office expenses, or education expenses. Consult a tax professional if needed to identify all applicable deductions.

Missing deadlines is a common problem leading to penalties and interest. Note important dates like tax filing deadlines and payment due dates. Plan ahead and submit your return before the deadline to avoid penalties.

Incorrect filing status can result in an inaccurate tax liability. Ensure you select the appropriate filing status (single, married filing jointly, etc.) based on your marital status and other relevant factors.

Ignoring estimated tax payments for self-employed individuals and others with significant unearned income can lead to underpayment penalties. Make timely estimated tax payments throughout the year to avoid penalties.

Failing to understand the rules around dependent care can lead to missed deductions or credits. If you have dependents, thoroughly review the qualifications for claiming them and applicable tax benefits.