Building wealth requires a strategic approach, and leveraging tax-advantaged accounts is a crucial component of any successful financial plan. This article explores how utilizing accounts like 401(k)s, IRAs, HSAs, and 529 plans can significantly accelerate your wealth-building journey by minimizing your tax burden and maximizing your investment returns. Discover the power of tax-efficient investing and learn how to strategically utilize these accounts to achieve your financial goals.

What Are Tax-Advantaged Accounts?

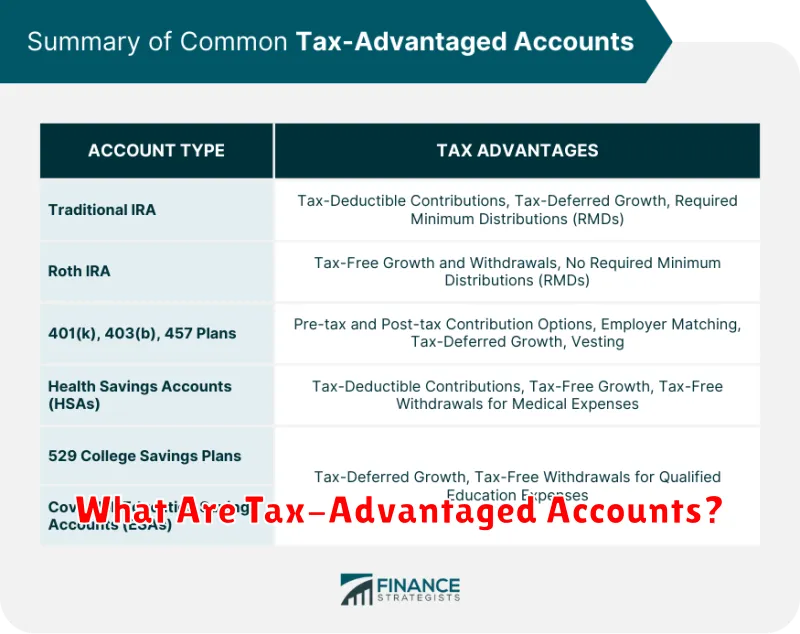

Tax-advantaged accounts are investment accounts that offer specific tax benefits to encourage saving and investing. These benefits can significantly reduce your tax burden and accelerate wealth accumulation.

Unlike traditional brokerage accounts where investment gains are taxed annually, tax-advantaged accounts provide various ways to defer or eliminate taxes on investment earnings. This allows your money to grow faster, compounding over time.

The most common types of tax-advantaged accounts include 401(k)s, IRAs (Traditional and Roth), and 529 plans. Each offers different benefits and rules depending on your individual circumstances and financial goals.

Understanding the nuances of each account type is crucial to maximizing their tax advantages and choosing the right one for your personal financial strategy. Proper planning can lead to substantial long-term savings and wealth building.

The Benefits of a Roth IRA vs Traditional IRA

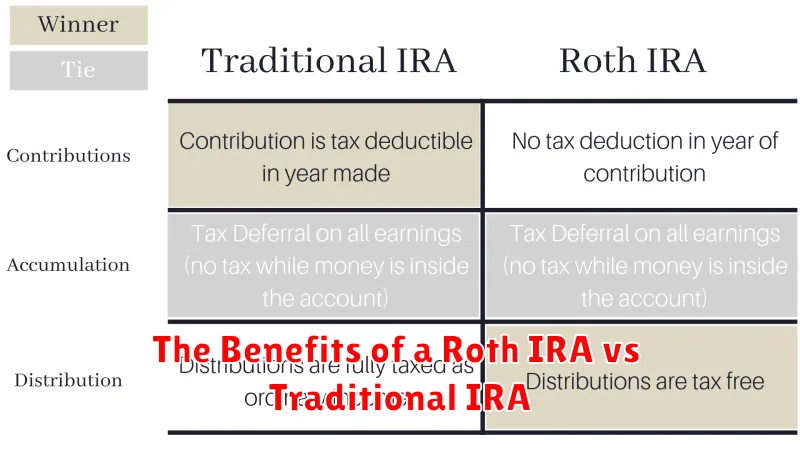

Choosing between a Roth IRA and a Traditional IRA is a crucial decision for building wealth. The primary difference lies in tax treatment. With a Traditional IRA, contributions are made pre-tax, reducing your current taxable income. However, withdrawals in retirement are taxed as ordinary income. A Roth IRA, conversely, involves contributions made with after-tax dollars. This means no upfront tax deduction, but withdrawals in retirement are tax-free.

The optimal choice depends on your individual circumstances and projections for future tax rates. If you anticipate being in a higher tax bracket in retirement than you are now, a Roth IRA is generally advantageous because you’ll pay taxes at your lower current rate. Conversely, if you expect to be in a lower tax bracket in retirement, a Traditional IRA may offer greater tax savings.

Beyond tax implications, both account types offer significant growth potential. Investments within either account grow tax-deferred, meaning you don’t pay taxes on investment gains until withdrawal. Understanding these key distinctions empowers you to strategically utilize tax-advantaged accounts to maximize your long-term wealth.

How to Maximize Contributions to Your 401(k)

Maximize your 401(k) contributions to accelerate wealth building through tax advantages. Understanding your contribution limits is crucial. The IRS sets annual contribution limits, which you should aim to reach. For 2023, the maximum contribution is $22,500, with an additional $7,500 catch-up contribution available for those age 50 and older.

Consider your employer’s matching contributions. Many employers match a percentage of your contributions, essentially providing free money. This is a significant opportunity to boost your retirement savings; contribute enough to receive the full match. Think of this as a guaranteed return on your investment.

Automatic escalation is another powerful tool. Set up automatic increases to your contribution percentage each year. Even small annual increases, such as 1%, can significantly impact your long-term savings due to the power of compounding.

Diversify your investments within your 401(k) to manage risk. Choose a mix of stocks and bonds appropriate for your age and risk tolerance. Consult a financial advisor for personalized guidance.

Regularly review your 401(k) statement to monitor performance and ensure your investments align with your goals. Address any needed adjustments proactively to stay on track.

Understanding Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged savings account used to pay for qualified medical expenses. It’s specifically designed for individuals enrolled in a high-deductible health plan (HDHP).

Key benefits of HSAs include triple tax advantages: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes HSAs a powerful tool for long-term wealth building, particularly for healthcare costs.

Eligibility for an HSA requires enrollment in a qualified HDHP. Contribution limits are set annually by the IRS and depend on the individual’s coverage status (single or family).

Qualified medical expenses encompass a broad range of healthcare costs, including doctor visits, prescription drugs, dental and vision care (sometimes with limitations), and more. It’s crucial to keep detailed records of expenses for tax purposes.

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, accumulating and growing tax-free. This feature makes HSAs especially attractive for long-term healthcare planning and retirement.

In short, HSAs offer a significant tax advantage and provide a valuable tool for individuals to save for and manage future healthcare costs while simultaneously building wealth.

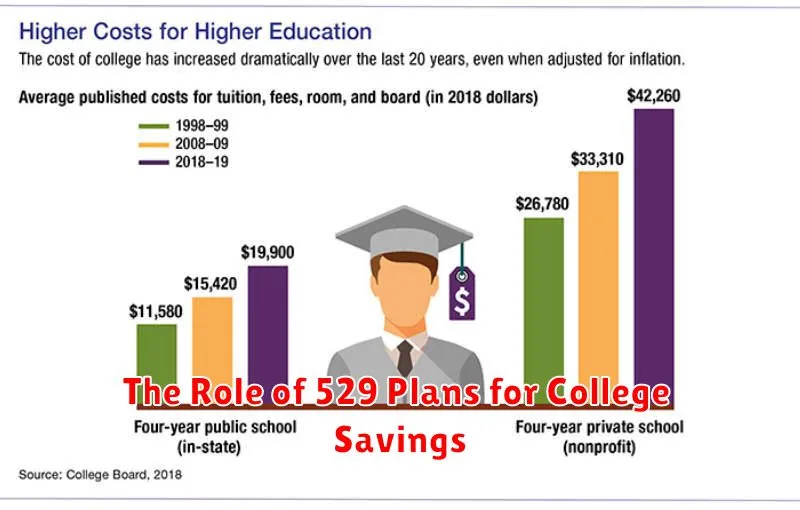

The Role of 529 Plans for College Savings

529 plans are state-sponsored education savings plans offering significant tax advantages for funding higher education. They allow contributions to grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

These expenses include tuition, fees, and room and board at eligible colleges and universities. Some plans also cover expenses for K-12 education. The tax benefits make 529 plans a powerful tool for building a substantial college fund without incurring significant tax burdens.

There are two main types of 529 plans: state-sponsored plans and private plans. State-sponsored plans often offer residents specific benefits or tax deductions. The choice depends on individual circumstances and the plan’s investment options and fees.

Careful planning is crucial. Understanding investment risk and fees is essential before investing. The ability to change investment options over time allows for adjustments based on the child’s age and the time horizon for college.

Contribution limits vary by state, but there are no income restrictions on who can contribute. Furthermore, while the funds are earmarked for education, there are penalties for non-qualified withdrawals, encouraging responsible use for educational purposes.

How to Use a SEP IRA for Business Owners

A Simplified Employee Pension plan (SEP) IRA is a retirement plan designed for self-employed individuals and small business owners. It offers significant tax advantages, allowing you to contribute a portion of your business profits, reducing your taxable income for the year.

Contributions: You can contribute up to 20% of your net self-employment income, or a maximum amount set by the IRS (this maximum changes yearly). These contributions are tax-deductible, lowering your tax burden. There are no complex administrative requirements compared to other retirement plans.

Tax Benefits: The key benefit is the tax-deductibility of contributions. This reduces your current taxable income, resulting in lower tax payments in the present. Your investment grows tax-deferred until retirement, further compounding the tax advantages.

Flexibility: SEP IRAs offer flexibility for business owners with varying incomes. Contributions fluctuate based on annual profit, allowing for adjustments depending on business performance.

Drawbacks: Contribution limits are relatively low compared to some other plans. It might not be suitable for those seeking more substantial retirement savings vehicles.

Setup: Setting up a SEP IRA is generally straightforward. You’ll need to open an IRA account with a financial institution that offers SEP IRAs. You’ll then make contributions as a business owner, often through a bank transfer or other designated method.

In summary, SEP IRAs provide a simple and tax-advantaged way for business owners to save for retirement. While contribution limits exist, the tax benefits can significantly impact your long-term financial well-being. Consulting with a financial advisor can help determine if a SEP IRA is the right retirement plan for your specific circumstances.

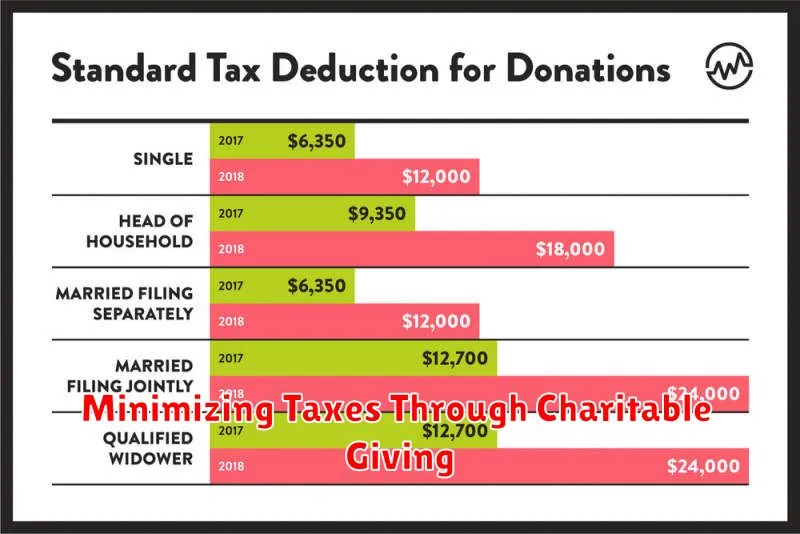

Minimizing Taxes Through Charitable Giving

Charitable giving offers a powerful strategy for reducing your tax burden while supporting worthy causes. By donating to qualified 501(c)(3) organizations, you can deduct your contributions from your taxable income. This deduction can significantly lower your overall tax liability, effectively increasing your after-tax wealth.

The amount you can deduct depends on your itemized deductions and your Adjusted Gross Income (AGI). For itemized deductions to be beneficial, the total amount must exceed the standard deduction. Consult a tax professional to determine the optimal donation strategy for your individual circumstances. They can help you maximize your tax savings while aligning your giving with your financial goals.

Different types of charitable contributions offer varying levels of tax benefits. For example, donating appreciated assets, such as stocks, can provide additional tax advantages beyond the deduction itself, as you avoid capital gains taxes. Careful planning and understanding of these nuances is essential for maximizing the tax benefits of charitable giving.

Remember that proper documentation is crucial. Always obtain and retain official receipts from the charities you support to substantiate your deductions when filing your tax return. Failing to do so could result in the IRS disallowing your deduction.

Avoiding Common Tax Mistakes

Utilizing tax-advantaged accounts effectively requires understanding and avoiding common errors. One frequent mistake is failing to contribute the maximum allowable amount to accounts like 401(k)s and IRAs. This missed opportunity significantly reduces potential long-term tax savings.

Another critical error is misunderstanding contribution limits and penalties for exceeding them. Staying informed about annual adjustments to contribution limits is crucial to avoid unnecessary penalties and tax implications.

Improperly withdrawing funds from tax-advantaged accounts before retirement can also lead to significant tax burdens. Understanding the rules regarding early withdrawals and potential penalties is vital for avoiding unexpected tax liabilities.

Finally, many individuals neglect to keep meticulous records of their contributions and withdrawals. Accurate and organized documentation is essential for accurate tax filings and helps avoid potential audits and complications.