Planning for a comfortable retirement in 2025 requires a robust savings strategy. This article explores the best retirement savings strategies for the coming years, covering topics such as maximizing 401(k) contributions, leveraging tax-advantaged accounts like Roth IRAs, and understanding investment diversification for optimal growth. We’ll delve into retirement planning best practices, focusing on financial security and achieving your desired retirement lifestyle. Learn how to navigate the complexities of pension plans, Social Security benefits, and other crucial aspects of retirement preparation.

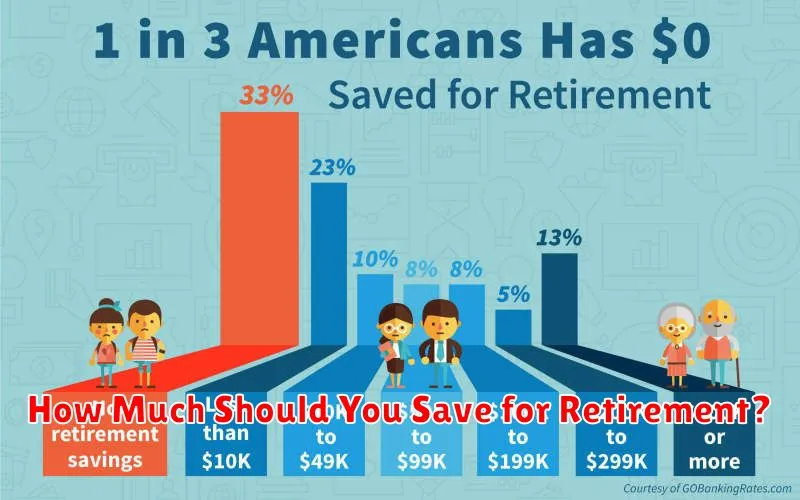

How Much Should You Save for Retirement?

Determining how much you should save for retirement depends on several key factors. These include your desired lifestyle in retirement, your current age, your expected retirement age, and your current savings.

A common rule of thumb is the 80% rule, suggesting you’ll need 80% of your pre-retirement income to maintain your lifestyle. However, this is a broad guideline and may not apply to everyone. Individual circumstances vary widely.

Financial advisors often use sophisticated calculations incorporating factors like inflation, investment growth, and longevity to provide personalized retirement savings estimates. Utilizing retirement calculators available online can also offer a preliminary assessment. Regardless of the method employed, the earlier you begin saving, the less you need to contribute each year to reach your goal.

Ultimately, there’s no single “correct” answer. It’s crucial to develop a realistic budget, considering both your spending habits and long-term financial goals. Regularly reviewing and adjusting your savings plan is essential to ensure it aligns with your evolving circumstances.

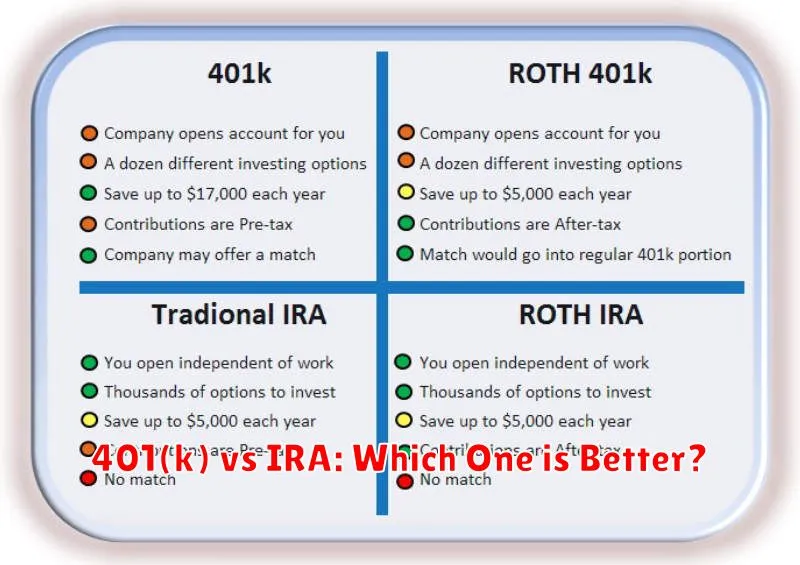

401(k) vs IRA: Which One is Better?

Choosing between a 401(k) and an IRA depends on your individual circumstances. A 401(k), offered through your employer, often includes an employer match, boosting your savings significantly. Contribution limits are generally higher than IRAs. However, investment options are usually more limited.

An IRA, on the other hand, provides greater investment flexibility. Traditional IRAs offer tax deductions on contributions, while Roth IRAs offer tax-free withdrawals in retirement. Contribution limits are lower than 401(k)s, but the broader investment choices can be advantageous.

Consider these factors: Your employer’s matching contributions (if any), your income level (affecting IRA deductions), your risk tolerance, and your long-term financial goals. If your employer offers a generous match, maximizing your 401(k) contributions is often a smart initial step. However, diversifying your retirement savings with an IRA can provide additional benefits.

Ultimately, the “better” option isn’t universally applicable. A combination of both a 401(k) and an IRA often represents the most effective retirement savings strategy.

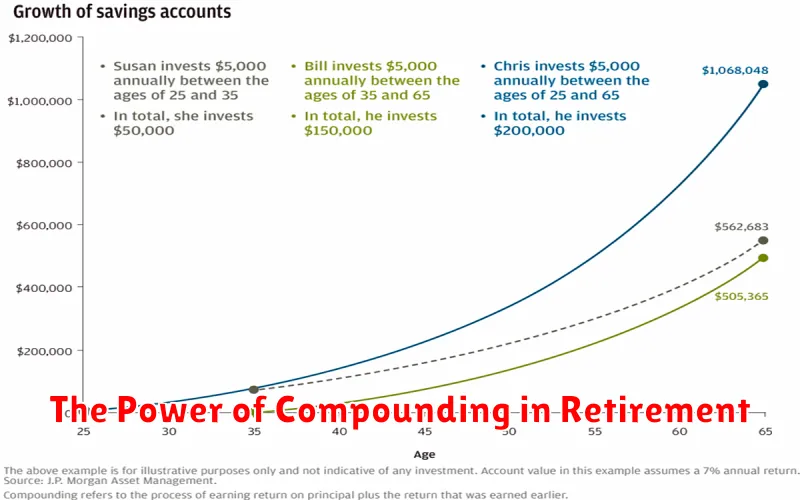

The Power of Compounding in Retirement

Compounding is the eighth wonder of the world, as Albert Einstein famously (though perhaps apocryphally) stated. In the context of retirement savings, it’s the snowball effect of earning returns on your initial investment and on the accumulated interest or earnings. This means your money grows exponentially over time, rather than linearly.

The earlier you start saving and investing, the greater the impact of compounding. Even small, consistent contributions can yield significant results over decades due to the power of exponential growth. This is because the returns you earn each year generate further returns in subsequent years, creating a cycle of accelerated growth.

Time is your greatest asset when it comes to compounding. The longer your money has to grow, the more time it has to generate returns on returns. This makes maximizing your contribution period crucial for maximizing your retirement savings.

Consistent investing is also key. Regularly contributing to your retirement accounts, even during periods of market volatility, allows you to take advantage of the upswings and potentially mitigate the impact of the downswings over the long term, maximizing the benefits of compounding.

Understanding and leveraging the power of compounding is a cornerstone of any successful retirement savings strategy. It’s the engine that drives long-term growth, turning modest contributions into substantial retirement nest eggs.

How to Reduce Taxes on Retirement Accounts

Minimizing your tax burden on retirement accounts is crucial for maximizing your savings. Several strategies can help achieve this goal.

Tax-advantaged accounts like traditional 401(k)s and IRAs offer upfront tax deductions, lowering your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income. Roth accounts, conversely, offer tax-free withdrawals in retirement, but contributions are not tax-deductible.

Diversification is key. Consider a mix of tax-advantaged and taxable accounts to strategically balance current and future tax liabilities. This approach allows you to tailor your approach based on your individual tax bracket and long-term financial goals.

Tax-loss harvesting, while not directly related to retirement accounts themselves, can help offset capital gains taxes from other investments, freeing up more money to contribute to your retirement savings.

Consult a financial advisor. A professional can help you create a personalized retirement plan that considers your individual circumstances and tax situation to optimize your tax efficiency.

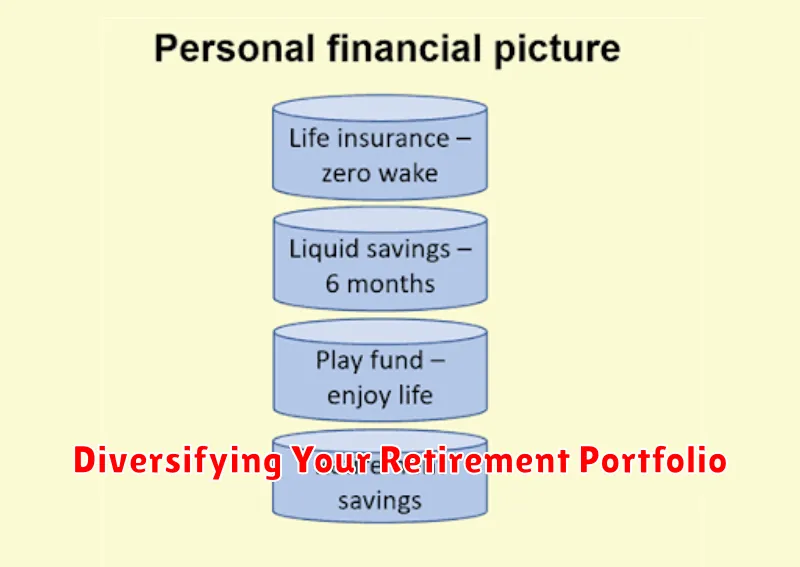

Diversifying Your Retirement Portfolio

Diversification is crucial for mitigating risk in your retirement portfolio. It involves spreading your investments across different asset classes to reduce the impact of poor performance in any single area. Don’t put all your eggs in one basket is the core principle.

Consider diversifying across stocks (both large-cap and small-cap, domestic and international), bonds (government, corporate, and municipal), and alternative investments (real estate, commodities, etc.). The ideal allocation will depend on your individual risk tolerance, time horizon, and financial goals. Consult a financial advisor to determine the best mix for your circumstances.

Regular rebalancing is also vital. As market conditions change, your portfolio’s asset allocation will drift. Rebalancing involves selling some assets that have grown beyond their target allocation and buying others that have fallen below. This helps maintain your desired level of risk and potentially improve long-term returns.

Furthermore, consider diversifying geographically. Investing in international markets can reduce your dependence on a single economy and potentially enhance returns. However, understand the added complexity and risks associated with international investments.

Finally, remember that diversification is an ongoing process, requiring regular review and adjustments. Market conditions and your personal circumstances may require changes to your investment strategy over time. Stay informed and adapt accordingly.

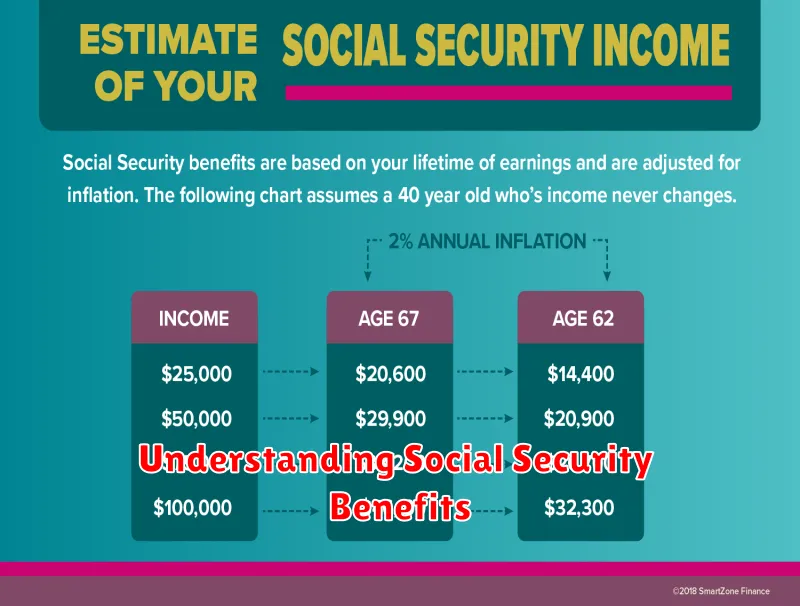

Understanding Social Security Benefits

Social Security benefits are a crucial component of retirement planning for many Americans. Understanding how these benefits work is essential for maximizing your retirement income.

Eligibility is based on your work history and earnings. You earn credits toward Social Security by working and paying Social Security taxes. The number of credits needed to qualify for benefits varies. The amount of your monthly benefit is determined by your average indexed monthly earnings (AIME) over your highest-earning 35 years.

Retirement age significantly impacts your benefit amount. The full retirement age (FRA) is gradually increasing and depends on your birth year. Claiming benefits before your FRA will result in a permanently reduced monthly payment, while delaying past your FRA increases your benefits. Consider this carefully as part of your retirement strategy.

Spousal and survivor benefits also exist. Spouses of qualifying individuals may receive benefits based on their spouse’s work record. Survivor benefits provide financial support to surviving spouses and children.

It is highly recommended to consult the Social Security Administration website or a financial advisor for personalized information and projections about your potential benefits. Planning for retirement should include a realistic assessment of your Social Security benefits.

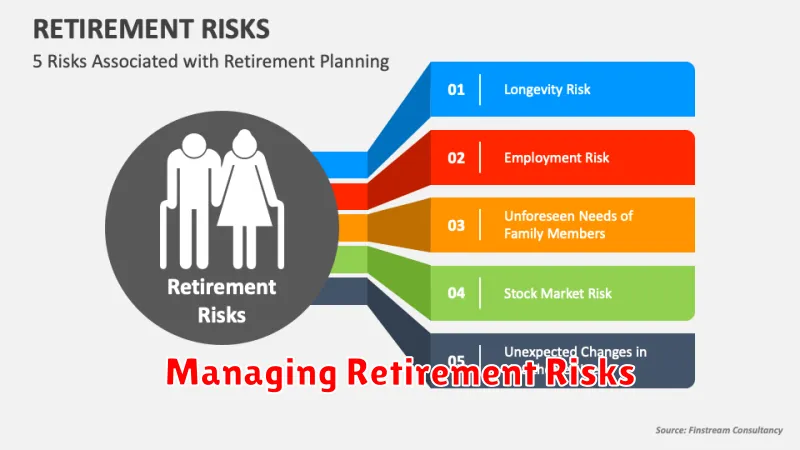

Managing Retirement Risks

Effective retirement planning necessitates a robust strategy for mitigating potential risks. Diversification is crucial; spreading investments across various asset classes (stocks, bonds, real estate) reduces the impact of poor performance in any single area. This helps to balance risk and reward.

Inflation poses a significant threat to retirement savings. The purchasing power of your savings can erode over time, so it’s vital to consider inflation-adjusted returns when making investment decisions. Regularly rebalancing your portfolio helps manage inflation risk.

Market volatility is an inherent risk in investing. To mitigate this, consider a long-term investment horizon. Short-term market fluctuations are less impactful over longer periods. A well-defined investment plan with a clear risk tolerance is essential.

Healthcare costs are a major concern for retirees. Planning for potential healthcare expenses is crucial. This includes understanding your health insurance options and potentially setting aside additional funds specifically for medical costs.

Unexpected events, such as job loss or unforeseen illnesses, can severely impact retirement savings. Having an emergency fund provides a buffer against such events and helps maintain financial stability.

Longevity risk, or outliving your savings, is a real possibility. Careful planning, considering life expectancy, and adjusting your savings strategy accordingly, is crucial to ensuring adequate funds for a comfortable retirement.

Regularly reviewing and adjusting your retirement plan is essential to adapt to changing circumstances and market conditions. Professional financial advice can provide valuable support in managing these risks effectively.

Retirement Planning Mistakes to Avoid

Failing to start early is a significant mistake. The power of compound interest means that even small contributions made early will grow substantially over time. Delaying significantly reduces your potential retirement savings.

Underestimating expenses is another common error. Healthcare costs, in particular, tend to rise significantly in retirement. Accurately projecting your future expenses is crucial for determining your savings needs.

Ignoring inflation can severely impact your retirement funds. The purchasing power of your savings will erode over time due to inflation. Failing to account for this will mean you have less money to spend in retirement than you anticipate.

Not diversifying investments exposes your savings to unnecessary risk. A diversified portfolio, spread across various asset classes, helps mitigate potential losses from any single investment performing poorly.

Withdrawing too early from retirement accounts can lead to significant tax penalties and reduce your available funds for later years. Carefully consider the tax implications of early withdrawals and plan accordingly.

Not having a written plan leaves your retirement goals vague and unfocused. A well-defined plan, outlining savings goals, investment strategies, and withdrawal plans, provides structure and direction.

Failing to adjust your plan as your life circumstances change is a critical oversight. Major life events like job loss, illness, or changes in family size necessitate adjustments to your retirement strategy.