Are you struggling with debt and dreaming of building wealth? Many believe these goals are mutually exclusive, but this article reveals how to simultaneously reduce debt and build wealth. Learn effective strategies to eliminate debt faster, boost your savings, and strategically invest your money to achieve both financial freedom and long-term wealth. Discover practical tips for budgeting, debt consolidation, and smart investing that will empower you to take control of your finances and achieve your financial aspirations.

Understanding Good Debt vs Bad Debt

Understanding the difference between good debt and bad debt is crucial for building wealth while reducing debt. Good debt is debt used to acquire assets that appreciate in value or generate income, thereby increasing your net worth. Examples include mortgages (on properties expected to appreciate), student loans (leading to higher earning potential), and business loans (for ventures that generate profit).

Conversely, bad debt is debt that doesn’t increase your net worth and often incurs high interest rates. This includes high-interest credit card debt, payday loans, and unsecured personal loans used for non-essential expenses. These debts often consume a significant portion of your income without generating a comparable return.

By strategically focusing on paying down bad debt first while leveraging good debt responsibly, you can achieve financial freedom. This requires careful budgeting, disciplined spending habits, and a proactive approach to debt management.

How to Prioritize Debt Repayment

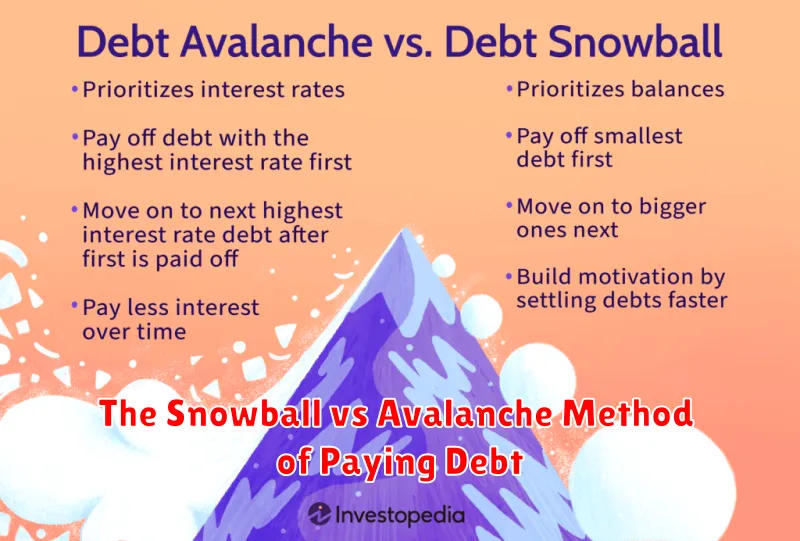

Effectively managing debt is crucial for building wealth. Prioritizing repayment strategies can significantly impact your financial progress. Two popular methods exist: the debt avalanche and the debt snowball method.

The debt avalanche method focuses on paying off high-interest debts first. This minimizes the total interest paid over time, leading to faster debt reduction and significant long-term savings. Calculate the interest rate on each debt and tackle the highest one first, while making minimum payments on the others.

The debt snowball method prioritizes paying off the smallest debts first, regardless of interest rate. This approach provides quicker psychological wins, boosting motivation to continue. Once the smallest debt is paid, the monthly payment is added to the next smallest debt, creating a “snowball” effect. While it may take longer to eliminate debt, the early wins can be encouraging.

Choosing the right method depends on your personality and financial goals. The avalanche method is mathematically superior, while the snowball method may be more psychologically beneficial. Consider your own strengths and weaknesses when making your decision.

Regardless of your chosen method, consistent budgeting and disciplined saving are vital. Creating a realistic budget helps allocate funds towards debt repayment and prevents further debt accumulation. Simultaneously building wealth requires allocating funds towards investments and savings after debt payments are met.

Creating a Budget for Debt Reduction

Creating a realistic budget is the cornerstone of successful debt reduction. Begin by tracking your income and expenses for a month to understand your spending habits. Categorize your expenses to identify areas where you can cut back.

Next, prioritize your debts. Consider using methods like the debt snowball (paying off smallest debts first for motivation) or the debt avalanche (paying off highest-interest debts first for financial efficiency). Allocate extra funds towards your prioritized debt payments.

Allocate a specific amount each month towards debt repayment. This amount should be as much as you can realistically afford without compromising essential needs. Consider adjusting your budget regularly to accommodate unexpected expenses and maximize debt repayment.

Automation can greatly simplify the process. Set up automatic payments for your debt minimums and allocate additional funds automatically to your chosen debt repayment strategy. This ensures consistent payments and minimizes the risk of missed payments.

Regularly review and adjust your budget. Life circumstances change, and your budget should adapt accordingly. This ensures your plan remains effective and keeps you on track towards your debt-free goals. Consistent monitoring and adjustment are crucial for long-term success.

The Snowball vs Avalanche Method of Paying Debt

When tackling debt, two popular strategies stand out: the snowball and the avalanche methods. Both aim to eliminate debt, but their approaches differ significantly.

The snowball method prioritizes paying off the smallest debts first, regardless of interest rate. This generates early wins, boosting motivation and providing a psychological advantage. The momentum created by paying off smaller debts fuels the process of tackling larger ones.

Conversely, the avalanche method focuses on paying off debts with the highest interest rates first. This approach is mathematically superior, minimizing the total interest paid over time and saving you money in the long run. While less psychologically rewarding initially, the long-term financial benefits are substantial.

Choosing between these methods depends on individual priorities. The snowball method is favored for its motivational aspect, while the avalanche method offers better financial efficiency. Consider your personal financial situation and personality when selecting the best strategy for you. The key is consistency and commitment to whichever method you choose.

How to Invest While Paying Off Debt

The seemingly contradictory goals of paying off debt and investing simultaneously are achievable with careful planning and prioritization. The key is to balance aggressive debt reduction with smart, low-risk investment strategies.

First, focus on high-interest debt. Prioritize paying down debts with the highest interest rates, such as credit cards, before tackling lower-interest loans like mortgages. This minimizes the overall interest paid and accelerates debt reduction.

Next, allocate a small portion of your income to investing. While paying down debt is crucial, neglecting investing entirely can hinder long-term wealth building. Start small; even a modest amount invested consistently can grow significantly over time. Consider low-fee index funds or high-yield savings accounts as suitable options.

Automate your savings and investments. Setting up automatic transfers to your investment and debt repayment accounts ensures consistent contributions regardless of fluctuations in income or spending. This creates a disciplined approach to both debt reduction and wealth accumulation.

Finally, review and adjust your strategy regularly. As your debt decreases and income increases, you can gradually increase your investment contributions while maintaining the focus on eliminating high-interest debt. Regular review ensures your plan remains aligned with your financial goals.

The Importance of an Emergency Fund

Building wealth while reducing debt requires a strategic approach, and a crucial component of that strategy is establishing an emergency fund. This fund acts as a financial safety net, protecting you from unexpected expenses that could derail your progress.

Unexpected events, such as medical emergencies, job loss, or car repairs, can easily wipe out savings and increase debt. An emergency fund prevents these setbacks from derailing your carefully planned debt reduction and wealth-building efforts. Having readily available funds minimizes the need to resort to high-interest debt, such as credit cards, to cover unforeseen costs.

The recommended size of an emergency fund is typically 3-6 months’ worth of living expenses. While building this fund may seem challenging while tackling debt, even a small emergency fund offers significant protection. Prioritize contributing consistently, even small amounts, to grow your safety net over time. This disciplined saving will reduce financial stress and allow you to focus effectively on your debt reduction goals without fear of unexpected crises.

In short, an emergency fund isn’t just a good idea—it’s a fundamental pillar of a successful debt reduction and wealth-building plan. It provides the stability and security necessary to withstand financial shocks, allowing you to remain focused on achieving your long-term financial goals.

Strategies for Increasing Your Income

Increasing your income is a crucial step in both reducing debt and building wealth. Several strategies can be employed to achieve this goal.

Negotiate a raise: Research industry salaries and present your accomplishments to your current employer. A well-prepared case can lead to a significant increase in your annual earnings.

Seek a higher-paying job: Explore job opportunities in your field or consider a career change that offers better compensation. Networking and updating your resume are key.

Develop new skills: Invest in education or training to enhance your qualifications and marketability. This can open doors to higher-paying positions.

Start a side hustle: Explore freelance work, part-time employment, or starting a small business to generate additional income streams. Consider your skills and interests when selecting a side hustle.

Invest wisely: While focusing on increasing income, make sure to allocate a portion towards investments that generate passive income. Carefully research different investment opportunities before making any decisions.

Reduce unnecessary expenses: While increasing income is key, managing expenses is equally important. Identifying and cutting unnecessary expenses can free up more money for debt repayment and investments.

How to Avoid Falling Back into Debt

Successfully reducing debt requires a proactive approach to prevent future accumulation. This involves establishing a robust budget and meticulously tracking your spending.

Emergency funds are crucial. Aim for 3-6 months’ worth of living expenses in a readily accessible account. This prevents borrowing for unexpected costs.

Mindful spending is paramount. Differentiate between needs and wants. Before making any significant purchase, evaluate its necessity and long-term impact on your financial goals.

Automate savings. Set up automatic transfers to your savings and investment accounts to ensure consistent contributions, building wealth while avoiding debt.

Regularly review your budget and spending habits. Adjust as needed to maintain financial stability and avoid the temptation to rely on credit.

Seek professional advice if needed. A financial advisor can provide personalized guidance and support in developing and maintaining a sound financial plan.