Investing in the stock market for long-term growth can be a powerful way to build wealth and secure your financial future. This comprehensive guide will equip you with the knowledge and strategies to successfully navigate the world of stock investing, helping you make informed decisions and achieve your long-term financial goals. Learn how to select high-growth stocks, manage risk effectively, and build a diversified investment portfolio to maximize your returns over time. Discover the secrets to passive income generation and wealth creation through strategic stock market investing. Whether you’re a seasoned investor or just starting out, this guide provides valuable insights for achieving long-term financial success.

Why Stocks Are a Great Long-Term Investment

Investing in stocks offers the potential for significant long-term growth exceeding other investment options like bonds or savings accounts. This is due to the inherent capacity of companies to grow and increase in value over time.

Historical data consistently demonstrates that the stock market, while volatile in the short term, tends to appreciate over the long run. By riding out market fluctuations, investors benefit from the power of compounding, where returns generate further returns.

Stocks provide ownership in companies, meaning investors participate directly in their success. This participation offers exposure to a broader economy and diverse range of industries, mitigating risk through diversification.

While risk is always present, a long-term approach allows for the absorption of short-term market corrections. The longer the investment timeframe, the greater the opportunity to recover from market downturns and benefit from subsequent market upturns.

Furthermore, stocks offer the potential for dividend income, providing a stream of passive income from the companies in which you invest. This supplementary income enhances overall returns.

How to Choose Stocks for Long-Term Growth

Choosing stocks for long-term growth requires a strategic approach focusing on fundamental analysis and company assessment. Avoid short-term market fluctuations and instead concentrate on the underlying strength and potential of the business itself.

Identify strong companies with a proven track record of profitability, consistent revenue growth, and a sustainable competitive advantage. Look for companies with strong management teams, innovative products or services, and a clear path to future growth.

Analyze financial statements carefully. Examine key metrics such as revenue growth, profit margins, debt levels, and return on equity (ROE). A strong balance sheet and consistent profitability are crucial indicators of long-term viability.

Consider the industry landscape. Invest in companies operating within growing industries with strong future prospects. Understanding industry trends is vital to assessing a company’s potential for long-term growth.

Diversify your portfolio to mitigate risk. Don’t put all your eggs in one basket. Spread your investments across different sectors and companies to reduce the impact of any single investment performing poorly.

Practice patience and discipline. Long-term investing requires a long-term perspective. Avoid impulsive decisions based on short-term market movements. Stick to your investment strategy and ride out market volatility.

Regularly review your portfolio and make adjustments as needed based on changes in company performance or market conditions. However, avoid frequent trading driven by emotional responses to short-term market fluctuations.

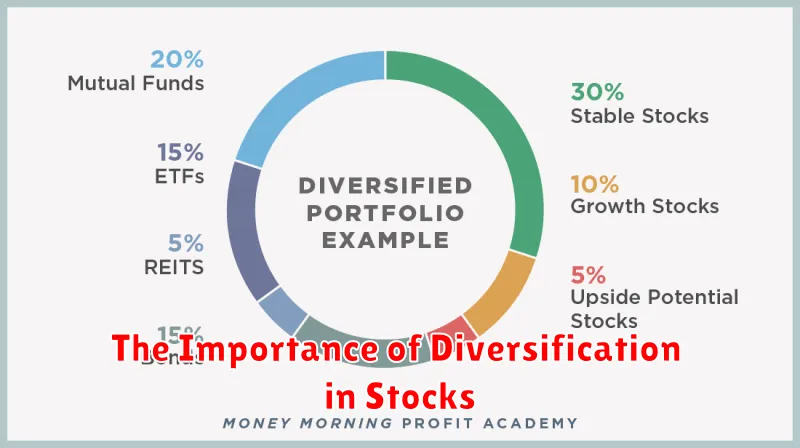

The Importance of Diversification in Stocks

Diversification is a cornerstone of long-term stock market success. It involves spreading investments across various assets to minimize risk. Instead of concentrating on a few stocks, a diversified portfolio includes different sectors, industries, and company sizes.

Reducing risk is the primary benefit. If one sector performs poorly, others might offset those losses. This protects your overall portfolio from significant downturns caused by a single company’s failure or an industry-specific crisis. It’s a form of risk mitigation.

Diversification doesn’t eliminate risk entirely, but it significantly reduces volatility. A well-diversified portfolio tends to experience smoother growth over the long term, compared to a concentrated portfolio prone to wild swings.

Different diversification strategies exist. You can diversify across geographies (international stocks), asset classes (bonds, real estate), or investment styles (value, growth). The optimal strategy depends on your individual risk tolerance and investment goals. Professional financial advice can help you determine the best approach.

In short, diversification is not just a good practice; it’s a critical component of a robust, long-term investment strategy. It helps manage risk, smooth out market fluctuations, and ultimately enhance your chances of achieving your financial goals.

Understanding Blue Chip vs Growth Stocks

Investing for long-term growth requires understanding different stock types. Blue chip stocks represent established, large companies with a history of consistent profitability and dividend payments. They are generally considered less risky than growth stocks but offer potentially lower returns.

Growth stocks, on the other hand, are shares in companies experiencing rapid expansion. These companies often reinvest profits back into the business rather than paying dividends, focusing on increasing market share and future earnings. They offer higher potential returns but come with significantly more risk.

The key difference lies in their focus: blue chips prioritize stability and consistent returns, while growth stocks prioritize aggressive expansion and future potential. Choosing between them depends on your risk tolerance and investment goals. A diversified portfolio often includes both types to balance risk and reward.

Consider your time horizon; growth stocks are generally better suited for longer-term investors comfortable with higher volatility. Blue chips are often preferred by investors seeking more stable, predictable income streams.

The Role of Dividends in Long-Term Investing

Dividends play a significant role in long-term investing strategies, offering several key advantages. They provide a consistent stream of income, allowing investors to reinvest those earnings for further growth or use them to supplement their income.

Furthermore, companies that consistently pay dividends often demonstrate financial stability and strength. This consistent payout indicates a healthy business model capable of generating profits and returning value to shareholders. This can be a positive indicator for long-term growth potential.

However, it’s crucial to remember that dividend payments are not guaranteed. Companies can reduce or eliminate dividends based on financial performance. Therefore, relying solely on dividends for income might not be a suitable strategy for every investor. It’s important to conduct thorough due diligence on a company’s financial health before investing based on its dividend payout.

Ultimately, dividends are a valuable component, but not the sole factor, of a successful long-term investment strategy. They should be considered alongside other crucial elements like company fundamentals, industry trends, and overall market conditions.

Best Strategies for Managing a Stock Portfolio

Successful long-term stock investing hinges on effective portfolio management. A key strategy is diversification, spreading investments across various sectors and asset classes to mitigate risk. This reduces the impact of any single investment’s underperformance.

Another crucial element is regular rebalancing. As your portfolio grows, some investments may outperform others, shifting the allocation away from your target percentages. Periodically adjusting your holdings back to your initial allocation ensures you maintain your desired risk level.

Dollar-cost averaging is a powerful technique. This involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

Long-term perspective is paramount. Avoid reacting emotionally to short-term market volatility. Focus on your investment goals and time horizon, making adjustments only when your circumstances or long-term outlook changes significantly.

Finally, consistent monitoring is essential but should not lead to impulsive trading. Regularly review your portfolio’s performance against your benchmarks, but avoid making frequent trades based on short-term market noise. Focus on the underlying fundamentals of your investments.

How to Avoid Stock Market Crashes

Completely avoiding stock market crashes is impossible; they are a natural part of the market cycle. However, you can significantly mitigate their impact through a diversified, long-term investment strategy.

Diversification is key. Don’t put all your eggs in one basket. Spread your investments across different sectors, asset classes (stocks, bonds, real estate, etc.), and geographies. This reduces the risk that a downturn in one area will severely impact your entire portfolio.

Long-term investing allows you to weather market fluctuations. Instead of focusing on short-term gains, aim for consistent, long-term growth. Market crashes are temporary setbacks in a long-term growth trajectory.

Dollar-cost averaging is a valuable strategy. Invest a fixed amount of money at regular intervals, regardless of market conditions. This reduces the impact of buying high and selling low.

Avoid panic selling during market downturns. Emotional decisions often lead to poor investment outcomes. Stick to your investment plan and avoid making rash changes based on short-term market volatility.

Regularly rebalance your portfolio. As your investments grow, some may outperform others, shifting the balance of your portfolio. Rebalancing helps maintain your desired asset allocation and risk profile.

Finally, understand your risk tolerance. Choose investment strategies that align with your comfort level with market fluctuations. If you’re risk-averse, prioritize lower-risk investments. It’s crucial to remember that investing always involves some level of risk.