Creating a robust investment plan is crucial for securing your financial future. This comprehensive guide will walk you through the essential steps to building an effective investment strategy tailored to your individual needs and financial goals. Learn how to determine your risk tolerance, diversify your portfolio, choose the right investment vehicles, and monitor your progress for long-term growth and wealth management. Discover how to navigate the complexities of investing and make informed decisions to achieve your financial objectives.

Understanding Your Financial Goals

Before creating any investment plan, it’s crucial to clearly define your financial goals. These goals provide the framework for your investment strategy and dictate your investment timeline, risk tolerance, and asset allocation.

Consider both short-term and long-term goals. Short-term goals might include saving for a down payment on a house or paying off debt within a few years. Long-term goals could encompass retirement planning, funding a child’s education, or ensuring financial security for your family.

Assigning a specific timeframe to each goal adds clarity and helps you select appropriate investment vehicles. For instance, short-term goals benefit from less risky, more liquid investments, while long-term goals allow for a greater risk tolerance to pursue potentially higher returns.

Quantifying your goals is equally important. Instead of vaguely aiming for “retirement,” determine the desired retirement income. Similarly, specify the target amount needed for a down payment or your child’s education. This quantification ensures you invest the necessary capital to achieve your ambitions.

Regularly review and adjust your financial goals as your circumstances change. Life events, career shifts, and unexpected expenses might require recalibrating your investment plan to remain on track towards your objectives.

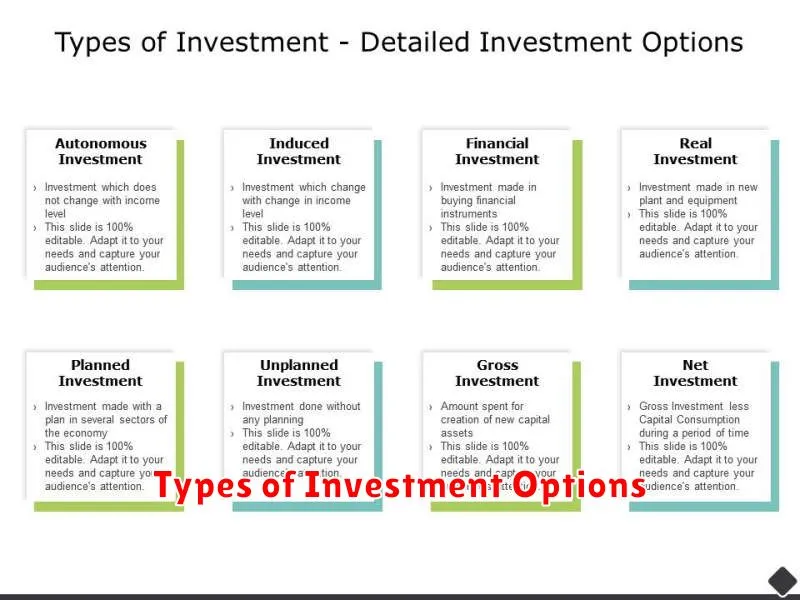

Types of Investment Options

Creating an effective investment plan requires understanding the various options available. Stocks represent ownership in a company and offer potential for high returns but also carry significant risk. Bonds, on the other hand, are loans to governments or corporations, generally considered less risky than stocks but with lower potential returns.

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management but come with fees. Exchange-traded funds (ETFs) are similar to mutual funds but trade on exchanges like stocks, offering more flexibility.

Real estate involves investing in properties for rental income or appreciation. It can offer significant returns but requires substantial capital and involves management responsibilities. Commodities such as gold or oil can act as a hedge against inflation but their prices can be volatile.

Finally, cash equivalents, such as savings accounts and money market accounts, offer liquidity and low risk but typically have low returns. The best investment strategy involves diversifying across asset classes based on your risk tolerance and financial goals. Careful consideration of each option’s risk and reward profile is crucial.

Risk Tolerance and Asset Allocation

Risk tolerance is a crucial factor in creating an effective investment plan. It refers to your comfort level with the possibility of losing money in pursuit of higher returns. A high-risk tolerance suggests you’re comfortable with potentially larger losses for the chance of greater gains, while a low-risk tolerance prioritizes capital preservation over significant growth.

Your risk tolerance directly influences your asset allocation. Asset allocation is how you distribute your investments across different asset classes, such as stocks, bonds, and cash. A higher risk tolerance might lead to a portfolio heavily weighted towards stocks, which historically offer higher returns but also greater volatility. Conversely, a lower risk tolerance typically results in a portfolio with a greater proportion of bonds and cash, offering stability but potentially lower returns.

Determining your risk tolerance involves self-assessment. Consider your financial goals, time horizon, and overall comfort level with market fluctuations. Online questionnaires and consultations with financial advisors can aid this process. Once established, your risk tolerance forms the foundation for a well-diversified asset allocation strategy tailored to your individual needs and circumstances.

Remember, a well-crafted asset allocation strategy should align with your risk tolerance and investment goals. Regularly reviewing and adjusting your portfolio based on your changing circumstances and market conditions is essential for long-term investment success.

Short-Term vs Long-Term Investments

When crafting an effective investment plan, understanding the difference between short-term and long-term investments is crucial. Short-term investments typically mature within one year, offering relatively low returns but high liquidity. Examples include money market accounts and short-term certificates of deposit (CDs). These are ideal for emergency funds or near-future goals.

Conversely, long-term investments are held for longer periods, generally exceeding one year, and aim for higher returns over time. Stocks, bonds, and real estate are common examples. While they offer the potential for significant growth, they are typically less liquid and subject to greater market fluctuations. The time horizon allows for weathering market volatility and benefiting from the power of compound interest.

The optimal mix of short-term and long-term investments depends on individual risk tolerance, financial goals, and time horizon. A balanced approach, diversifying across asset classes and investment timeframes, is often recommended to mitigate risk and maximize potential returns.

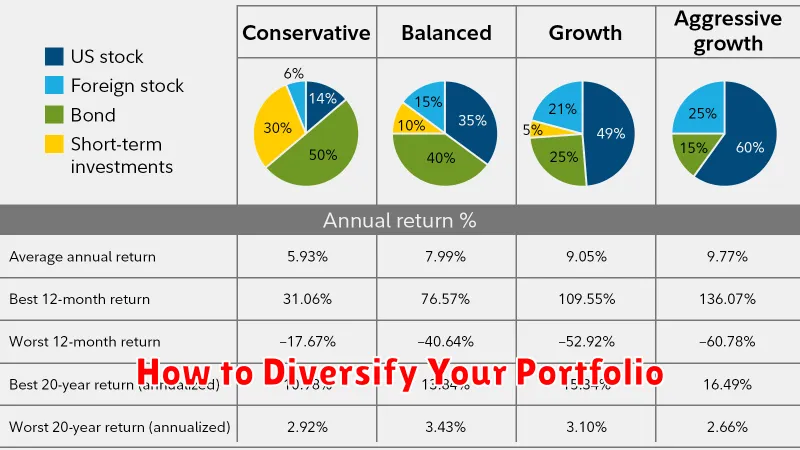

How to Diversify Your Portfolio

Diversification is a crucial element of any effective investment plan. It involves spreading your investments across different asset classes to reduce risk and potentially enhance returns. Don’t put all your eggs in one basket is the core principle.

A diversified portfolio typically includes a mix of stocks, bonds, real estate, and potentially alternative investments like commodities or private equity. The specific allocation will depend on your individual risk tolerance, investment goals, and time horizon.

Stocks offer potential for high growth but also carry higher risk. Bonds generally provide lower returns but are considered less risky. Real estate can offer diversification benefits and potential for income generation. Alternative investments can add further diversification but often come with higher complexity and potential illiquidity.

Consider your risk tolerance when diversifying. A younger investor with a longer time horizon might tolerate more risk and allocate a larger portion of their portfolio to stocks. An older investor closer to retirement might prefer a more conservative approach with a greater allocation to bonds.

Regularly rebalance your portfolio to maintain your desired asset allocation. As market conditions change, some investments may outperform others, causing your portfolio to drift from your target allocation. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to restore the desired balance.

Professional advice is recommended, especially for those new to investing or managing significant assets. A financial advisor can help you create a diversified portfolio tailored to your specific needs and risk profile.

The Role of Compound Interest in Investing

Compound interest is the core principle behind long-term wealth building. It’s the interest earned not only on your initial investment (principal), but also on the accumulated interest itself. This creates a snowball effect, where your returns grow exponentially over time.

To illustrate, imagine investing $10,000 with a 7% annual return. In the first year, you earn $700. In the second year, you earn $749 (7% of $10,700), and so on. This seemingly small difference compounds significantly over decades, resulting in a much larger final balance than simple interest would provide.

The power of compounding is maximized through consistent investing and longer time horizons. The earlier you start investing, the more time your money has to grow, and the greater the benefit of compound interest will be. Therefore, understanding and leveraging compound interest is crucial for creating an effective investment plan.

Time is a critical factor in maximizing compound interest. While a higher rate of return is desirable, consistent contributions and a longer investment timeline are equally, if not more, important in achieving substantial growth.

Choosing Between Stocks, Bonds, and Real Estate

Creating an effective investment plan requires careful consideration of asset allocation. Stocks, bonds, and real estate offer distinct risk and return profiles. Understanding these differences is crucial for aligning your investments with your financial goals and risk tolerance.

Stocks represent ownership in a company and offer the potential for high returns, but also carry significant risk. Their value can fluctuate dramatically based on market conditions and company performance. Bonds, on the other hand, are debt instruments issued by governments or corporations, generally considered less risky than stocks. They offer a fixed income stream but typically provide lower returns.

Real estate investments, such as property ownership, can provide both income (through rental payments) and potential appreciation in value. However, real estate investments often require substantial upfront capital and are relatively illiquid compared to stocks and bonds. They also involve ongoing expenses like maintenance and property taxes.

The optimal mix of these assets depends on individual circumstances. A younger investor with a higher risk tolerance might favor a portfolio heavily weighted towards stocks, while an older investor nearing retirement might prioritize bonds for stability. Diversification across all three asset classes can help manage risk and potentially enhance overall returns.

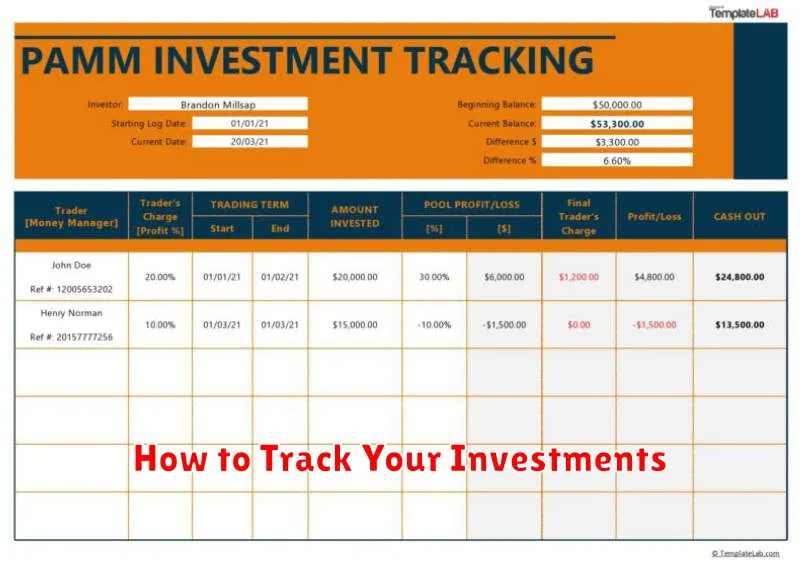

How to Track Your Investments

Tracking your investments is crucial for effective financial planning. Regular monitoring allows you to assess the performance of your portfolio and make informed decisions.

There are several methods to track your investments. Spreadsheet software like Microsoft Excel or Google Sheets provides a simple, customizable option. You can manually input data or link it to your brokerage accounts for automated updates. Alternatively, many brokerage platforms offer built-in portfolio tracking tools, providing a convenient and often comprehensive overview of your investments.

Key metrics to track include your total portfolio value, individual asset performance, returns (both absolute and relative to benchmarks), and overall asset allocation. Paying attention to these metrics will help you understand the health of your portfolio and identify any areas needing adjustment.

Consistent tracking, ideally monthly or quarterly, is recommended. This allows for early detection of underperforming assets or shifts in market trends, enabling timely intervention to mitigate potential losses or capitalize on opportunities.

Finally, remember that tracking is not just about numbers. It’s about understanding your investment strategy’s effectiveness and making necessary adjustments to align with your long-term financial goals.