Choosing the right financial consultant can significantly impact your financial future. This crucial decision requires careful consideration of your individual financial needs, goals, and risk tolerance. Finding a qualified professional who understands your unique circumstances and can provide personalized financial advice is paramount. This guide will help you navigate the process of selecting a financial consultant who aligns perfectly with your investment strategy and long-term financial objectives.

What Does a Financial Consultant Do?

A financial consultant provides personalized advice and guidance on various financial matters. Their services aim to help individuals and businesses achieve their financial goals.

Key responsibilities often include developing financial plans, managing investments, offering retirement planning strategies, and providing tax planning assistance. They may also help with estate planning, insurance needs, and debt management.

The specific services offered can vary depending on the consultant’s expertise and the client’s needs. However, the overarching goal is to help clients make informed financial decisions to improve their overall financial well-being.

In essence, a financial consultant acts as a trusted advisor, helping clients navigate the complexities of personal finance to achieve long-term financial success.

The Difference Between a Consultant and a Financial Advisor

While the terms “consultant” and “financial advisor” are often used interchangeably, there’s a key distinction. A financial advisor typically holds a series of licenses and registrations (like the Series 65 or 7) allowing them to offer investment advice and sell financial products such as insurance or mutual funds. They have a fiduciary duty, meaning they are legally obligated to act in your best interest.

A financial consultant, on the other hand, may or may not hold such licenses. They might provide broader financial guidance, including areas like budgeting, debt management, or retirement planning, without necessarily managing investments. Their services can be more generalized, focusing on strategic financial planning rather than specific investment recommendations. The level of fiduciary duty, if any, will vary greatly depending on the consultant’s specific agreement with the client.

In short, a financial advisor usually focuses on investment management and has specific legal obligations, while a financial consultant offers a wider array of services but might not manage investments or have the same regulatory oversight.

How to Assess a Consultant’s Qualifications

Choosing the right financial consultant is crucial. Thoroughly assessing their qualifications is the first step towards making an informed decision. Begin by verifying their credentials and certifications. Look for designations like Certified Financial Planner (CFP®) or Chartered Financial Analyst (CFA), indicating a commitment to professional standards and ongoing education.

Investigate their experience. How long have they been in the industry? What types of clients have they served? A strong track record with clients facing similar financial situations as yours is a positive sign. Review their specializations; ensure their expertise aligns with your needs (e.g., retirement planning, investment management, tax optimization).

Examine their professional background. Look for any disciplinary actions or complaints filed against them with regulatory bodies. References from previous clients can provide valuable insights into their work ethic, communication style, and the quality of their services. Don’t hesitate to ask specific questions about their approach, fees, and the process they follow.

Finally, consider their communication style and overall compatibility. A successful client-consultant relationship requires clear communication and mutual trust. Choose a consultant you feel comfortable with and confident in their abilities to guide you towards your financial goals.

Fee-Based vs Commission-Based Consultants

Choosing between a fee-based and a commission-based financial consultant is a crucial first step in securing your financial future. Understanding the fundamental differences in their compensation structures is key to making an informed decision.

Fee-based consultants charge a predetermined fee for their services, regardless of the outcome of their advice. This fee can be hourly, project-based, or an annual retainer. The advantage is transparency; you know exactly what you’re paying upfront. This structure minimizes potential conflicts of interest, as the consultant’s income isn’t directly tied to the products they recommend.

Commission-based consultants earn income through commissions on the financial products they sell, such as insurance policies or mutual funds. While this model can result in lower upfront costs, it introduces a potential conflict of interest. The consultant’s incentive is to sell products, even if they aren’t necessarily the best fit for your individual needs and risk tolerance. Transparency in commission structures can be limited, making it difficult to assess the true cost of their advice.

Ultimately, the best choice depends on your individual circumstances and priorities. If transparency and unbiased advice are paramount, a fee-based consultant is generally preferred. However, if minimizing immediate costs is your primary concern, a commission-based consultant might seem attractive, though careful due diligence is critical to mitigate potential risks.

When to Hire a Financial Consultant

Consider hiring a financial consultant when you face complex financial situations requiring expert guidance. This includes significant life events like inheritance, marriage, or divorce, where careful planning is crucial. Retirement planning, especially with nearing retirement age or significant assets, often benefits from professional advice.

Significant debt, especially high-interest debt, can be effectively managed with a financial consultant’s expertise. Similarly, if you’re planning major purchases like a home or starting a business, professional financial advice can prevent costly mistakes and ensure sound financial decisions.

If you feel overwhelmed by managing your finances or lack the time or knowledge to make informed decisions, seeking professional help is a wise choice. A financial consultant can provide objective analysis and create a personalized plan tailored to your specific needs and goals.

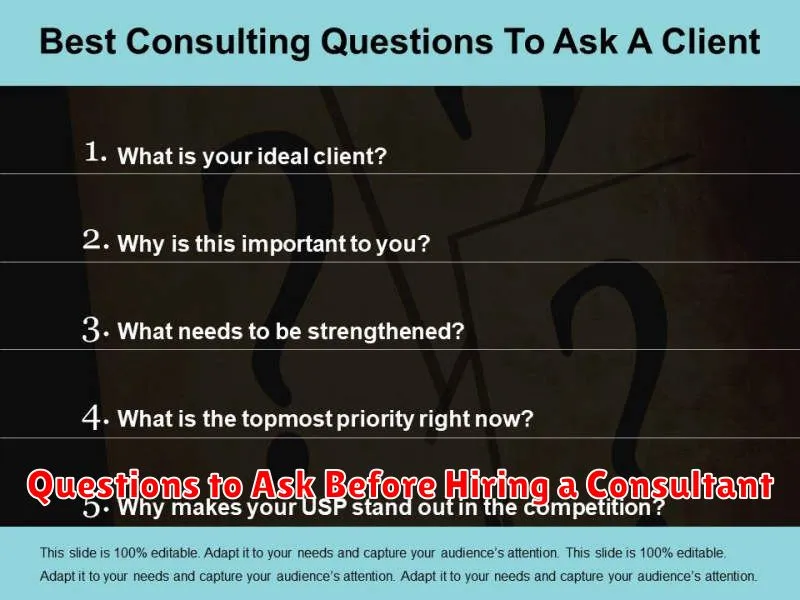

Questions to Ask Before Hiring a Consultant

Choosing the right financial consultant is crucial. Before committing, ask these vital questions:

What are your qualifications and experience? Verify certifications and years of experience in relevant areas. Look for a proven track record.

What is your fee structure? Understand how they charge – hourly, project-based, or percentage of assets under management – to avoid hidden costs.

What is your investment philosophy and approach? Ensure their style aligns with your risk tolerance and financial goals. Are they passive or active investors?

Can you provide references? Contact past clients to gauge their satisfaction and experience with the consultant’s services and communication.

What is your process for managing client accounts? Understand their communication frequency, reporting methods, and how they handle potential conflicts of interest.

What are your areas of expertise? Confirm they have the specific knowledge to handle your unique financial needs, such as retirement planning, tax optimization, or estate planning.

What are your contingency plans? Inquire about their processes during market downturns or unexpected events. How will they manage your investments during challenging times?

What are your professional affiliations and memberships? This provides insight into their commitment to professional standards and ethical practices.

Thoroughly researching and asking these questions will help ensure you choose a competent and trustworthy financial consultant who is the right fit for your needs.

How to Evaluate the Performance of Your Consultant

Evaluating a financial consultant’s performance requires a multifaceted approach. Begin by clearly defining your initial goals and expectations. Did the consultant effectively communicate the plan? Were you kept informed of progress?

Next, assess the results achieved. Did your investments perform as projected? Did the consultant meet the established financial targets? Consider both short-term and long-term outcomes. Compare actual returns against benchmarks, carefully examining any discrepancies.

Beyond numerical results, evaluate the consultant’s professionalism and communication. Were they responsive, readily available, and transparent in their dealings? Did they provide clear explanations and address your concerns effectively? Consider the overall quality of service and your comfort level.

Finally, scrutinize the fees. Were they transparent and competitive? Did the fees align with the services rendered and the results obtained? Analyze the value proposition in its entirety.

By considering these factors – goals achieved, performance against benchmarks, professional conduct, and fee structure – you can gain a comprehensive understanding of your consultant’s performance and determine whether their services align with your needs.