Are you seeking passive income streams to supplement your current earnings or build long-term wealth? This article explores the best investment vehicles for generating passive income, examining various options such as real estate, dividend-paying stocks, bonds, and peer-to-peer lending. We will analyze the risks and rewards of each, helping you determine the most suitable investment strategy for your financial goals and risk tolerance. Discover how to achieve financial freedom through smart, passive income generation.

What is Passive Income Investing?

Passive income investing involves generating income with minimal ongoing effort. Unlike active income, which requires consistent work (e.g., a salary), passive income streams continue to generate revenue even when you’re not directly involved in the day-to-day operations.

Key characteristics of passive income investing include: a relatively low time commitment after the initial setup; consistent, recurring revenue; and the potential for scalability, meaning the income stream can grow with minimal additional work. However, it’s important to note that while “passive,” most passive income strategies require some initial investment of time and/or money, and ongoing monitoring and maintenance are often necessary.

Examples of passive income investments include: real estate (rental properties), dividend-paying stocks, peer-to-peer lending, and royalties from creative works. The level of “passiveness” varies depending on the chosen investment vehicle.

Dividend Stocks: Best for Long-Term Cash Flow

Dividend stocks offer a compelling strategy for generating passive income. By investing in companies with a history of consistent dividend payouts, investors can receive regular cash distributions, supplementing their income stream over the long term.

Stability is a key advantage. Established companies with strong financial performance are more likely to maintain or increase their dividends, providing a reliable source of cash flow. This contrasts with other investments where returns are less predictable.

However, it’s crucial to perform due diligence. Thoroughly research companies before investing, focusing on their financial health, dividend history, and future prospects. A diversified portfolio of dividend stocks can help mitigate risk.

While dividend yields may fluctuate, the long-term growth potential of the underlying stocks contributes significantly to overall returns. This combination of income and capital appreciation makes dividend stocks an attractive option for building wealth over time.

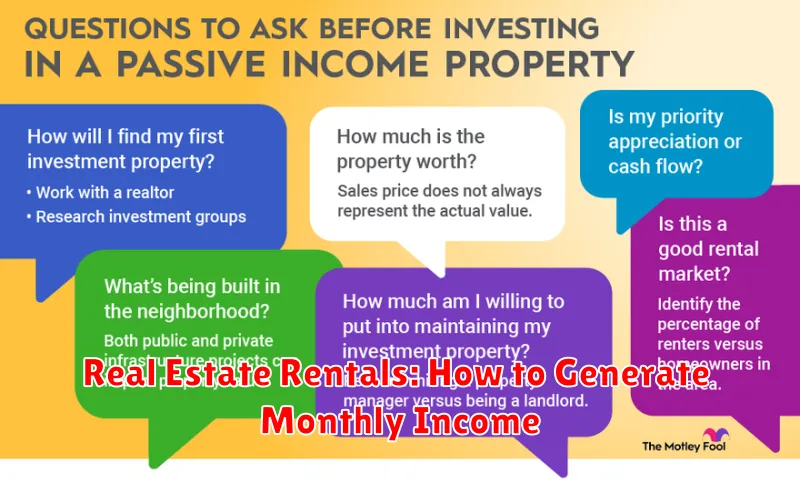

Real Estate Rentals: How to Generate Monthly Income

Real estate rentals offer a potentially lucrative avenue for generating passive income. Cash flow is the key; the rental income should exceed all expenses, including mortgage payments, property taxes, insurance, maintenance, and vacancy costs.

To maximize profitability, thorough research is crucial. Analyze market trends, rental rates, and potential expenses for different properties. Consider factors such as location, property condition, and tenant demand. Due diligence, including property inspections and appraisals, is essential before purchasing.

Effective property management is vital for consistent income. This can involve hiring a professional property manager or actively managing the property yourself. Promptly addressing maintenance requests and effectively screening tenants significantly reduces potential losses from vacancy or damages.

While real estate rentals offer strong potential, it’s important to understand the risks involved. These include fluctuating market values, unexpected repairs, tenant issues, and potential periods of vacancy. Diversification within your investment portfolio can help mitigate these risks.

Careful planning and a proactive approach to property management are essential for success in generating consistent monthly income from real estate rentals. Building a solid foundation with thorough research and effective strategies is crucial to realizing the long-term benefits of this investment strategy.

REITs vs Direct Real Estate Investment

Choosing between REITs (Real Estate Investment Trusts) and direct real estate investment depends on your investment goals and risk tolerance. REITs offer diversification, liquidity, and relatively low barriers to entry. They are traded on exchanges like stocks, providing easy buying and selling. However, returns are often dependent on market conditions and may not match the potential appreciation of direct real estate ownership.

Direct real estate investment, such as purchasing rental properties, offers greater potential for appreciation and higher returns through rental income and property value increases. However, it requires a significant capital investment, involves higher management responsibilities (including property maintenance and tenant relations), and is significantly less liquid than REITs. The potential for higher risk also exists due to factors like property market fluctuations and unexpected repairs.

Ultimately, the best choice hinges on your individual circumstances. REITs are suitable for investors seeking diversification and relatively passive income streams with lower risk. Direct real estate investment is more appropriate for those with greater capital, higher risk tolerance, and a willingness to actively manage their investment.

Peer-to-Peer Lending for Alternative Income

Peer-to-peer (P2P) lending offers an alternative avenue for generating passive income. It involves lending money to individuals or businesses through online platforms, bypassing traditional financial institutions. Investors earn interest on the loans they provide.

Returns can be higher compared to traditional savings accounts, but also carry higher risk. Thorough due diligence, including assessing borrower creditworthiness and platform reputation, is crucial. Diversification across multiple loans can help mitigate risk.

Liquidity can be a concern, as accessing funds may take time depending on the loan terms. The platform’s fee structure should also be carefully considered, as it can impact overall returns. Careful research and understanding of the inherent risks are paramount before investing in P2P lending.

Building a Portfolio of Passive Income Assets

Building a diversified portfolio of passive income assets is crucial for long-term financial security. Diversification minimizes risk by spreading investments across various asset classes, reducing the impact of poor performance in any single area. A well-structured portfolio might include a mix of higher-risk, higher-reward investments and lower-risk, steadier options.

Real estate, such as rental properties or REITs (Real Estate Investment Trusts), can provide consistent cash flow through rental income. However, management fees and unexpected repairs should be factored into projected returns. Dividend-paying stocks offer another avenue, providing regular income streams from company profits. Careful selection of stable, established companies is vital for maximizing returns and minimizing risk.

Peer-to-peer lending platforms allow individuals to lend money to borrowers and earn interest. While potentially lucrative, this involves a higher degree of risk compared to more established investment vehicles. Bonds generally offer lower returns but are considered relatively safe investments, providing a stable element to the portfolio. Finally, high-yield savings accounts and certificates of deposit (CDs) offer liquidity and low risk but typically generate lower returns than other options.

The optimal portfolio composition depends on individual risk tolerance, financial goals, and time horizon. Professional financial advice is recommended to create a personalized strategy tailored to specific circumstances. Regularly reviewing and adjusting the portfolio based on market conditions and personal goals is essential for maximizing passive income and long-term success.

Common Pitfalls in Passive Income Investing

While passive income investing offers the allure of financial freedom, several pitfalls can significantly hinder success. Lack of due diligence is a primary concern. Failing to thoroughly research investment opportunities, including understanding associated risks and fees, can lead to substantial losses.

Over-diversification, while seemingly beneficial, can actually dilute returns and complicate management. Spreading investments too thinly across numerous low-yielding assets may not generate sufficient passive income to offset effort and costs.

Ignoring market volatility is another significant risk. Passive income streams, particularly those from stocks and real estate, are susceptible to market fluctuations. Failing to account for potential downturns can lead to unexpected financial setbacks.

High initial investment costs can be a significant barrier to entry for some investment vehicles. The upfront costs associated with certain options, such as real estate, can prevent individuals from accessing potentially lucrative passive income opportunities.

Finally, underestimating the time and effort required is a common mistake. Even seemingly “passive” investments require ongoing monitoring, maintenance, and occasional active management to optimize performance and mitigate risks.