Are you seeking to maximize your investment returns while minimizing your tax burden? This article explores the best tax-efficient investment strategies for building long-term wealth. We’ll delve into proven methods to legally reduce your tax liability, including tax-advantaged accounts like 401(k)s and IRAs, strategic asset allocation, and smart tax-loss harvesting techniques. Discover how to protect your hard-earned money and grow your investments more efficiently with these powerful strategies designed to help you achieve your financial goals.

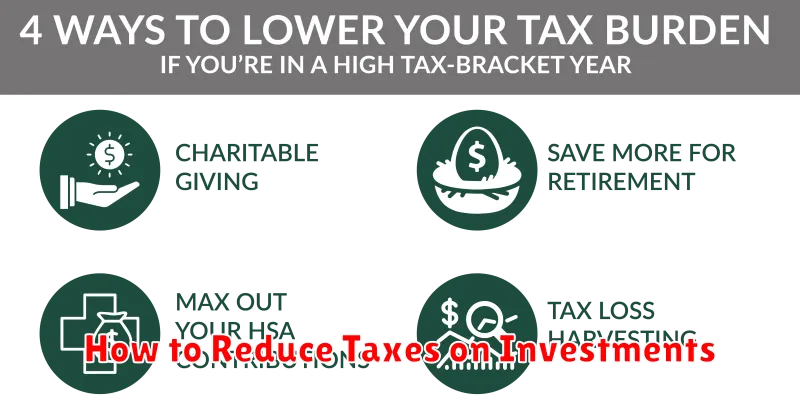

How to Reduce Taxes on Investments

Minimizing your tax burden on investments requires a strategic approach. Tax-advantaged accounts, such as 401(k)s and IRAs, offer significant tax benefits by either deferring or eliminating taxes on investment growth. Contributing to these accounts reduces your taxable income immediately, lowering your current tax liability.

Diversification across various asset classes can also play a role. Some investments, like municipal bonds, offer tax-exempt income, helping to reduce your overall tax bill. Careful consideration of your investment timeline is crucial; long-term capital gains are generally taxed at lower rates than short-term gains. Holding investments for a longer period can therefore prove beneficial.

Tax-loss harvesting is another effective strategy. This involves selling losing investments to offset capital gains, reducing your taxable gains. Consult with a qualified financial advisor to determine the most suitable tax-efficient strategies for your specific financial situation and risk tolerance. They can help you navigate the complexities of tax laws and optimize your investment portfolio for maximum tax efficiency.

Tax-Free Investment Options

Several investment options offer tax advantages, allowing your investments to grow without immediate tax liabilities. Tax-advantaged accounts like Roth IRAs and 529 plans offer significant tax benefits. With a Roth IRA, contributions are made after tax, but qualified withdrawals in retirement are tax-free. 529 plans are designed for education savings, with earnings growing tax-deferred and tax-free withdrawals for qualified education expenses.

Municipal bonds are another avenue for tax-free growth. Interest earned from these bonds is often exempt from federal income tax, and sometimes state and local taxes as well. However, it’s crucial to understand that municipal bonds typically offer lower yields compared to taxable bonds.

Life insurance policies, particularly permanent policies, can offer tax advantages. Death benefits are usually tax-free to beneficiaries, and some cash value growth may also be tax-deferred. However, complex rules and fees apply, so careful consideration is necessary.

The best tax-free investment option depends on your individual financial goals, risk tolerance, and tax bracket. It’s essential to consult with a financial advisor to determine the most suitable strategy for your specific circumstances.

Understanding Capital Gains Tax Rules

Capital gains tax applies to profits earned from selling assets held for investment purposes, such as stocks, bonds, or real estate. Understanding the tax rules is crucial for maximizing investment returns.

The tax rate on capital gains varies depending on your income bracket and how long you held the asset. Short-term capital gains (assets held less than one year) are taxed at your ordinary income tax rate. Long-term capital gains (assets held one year or longer) generally receive more favorable tax rates.

Taxable events trigger capital gains tax. These events include selling an asset for a profit, exchanging an asset, or receiving certain distributions from investments. It’s important to accurately track your basis (original cost) of each asset to correctly calculate your gain or loss.

Several strategies can help minimize your capital gains tax liability. These include harvesting losses to offset gains, utilizing tax-advantaged accounts (like 401(k)s and IRAs), and carefully timing the sale of assets. Consult with a tax professional for personalized advice.

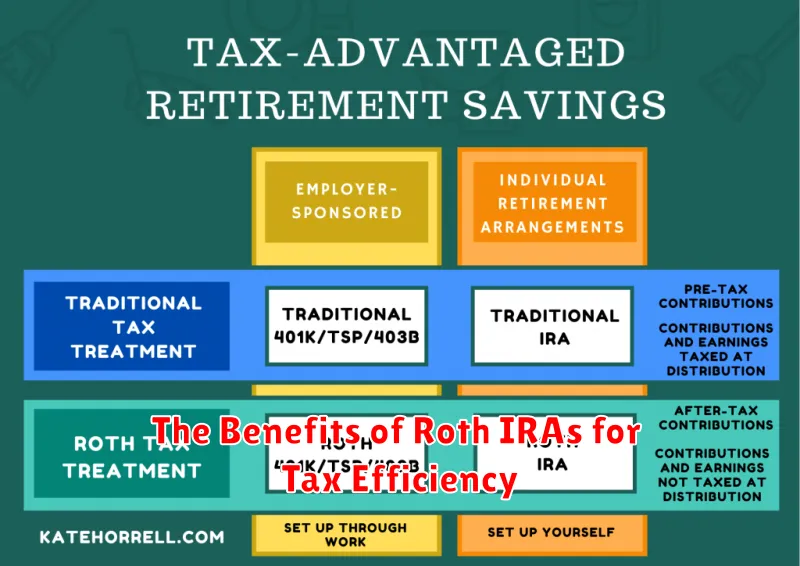

The Benefits of Roth IRAs for Tax Efficiency

Roth IRAs offer significant tax advantages for long-term investors. The primary benefit is that qualified withdrawals in retirement are completely tax-free.

Unlike traditional IRAs, where contributions may be tax-deductible but withdrawals are taxed in retirement, Roth IRAs involve taxing contributions upfront but enjoying tax-free growth and withdrawals later. This makes Roth IRAs particularly appealing for those who anticipate being in a higher tax bracket in retirement than they are currently.

Furthermore, earnings grow tax-deferred within the Roth IRA, meaning you avoid paying taxes on investment gains until withdrawal. This compounding tax-free growth can significantly boost your retirement savings over time.

Another key benefit is the ability to withdraw contributions at any time, tax- and penalty-free. This flexibility provides a safety net for unforeseen circumstances while still preserving the tax-advantaged growth of your earnings.

While the upfront tax payment may seem like a disadvantage, the long-term tax-free growth and withdrawals make Roth IRAs a powerful tool for building a tax-efficient retirement nest egg. The optimal choice between a Roth IRA and a traditional IRA depends on individual circumstances and projections of future tax brackets.

How to Use Municipal Bonds to Lower Taxes

Municipal bonds, issued by state and local governments, offer a powerful tool for lowering your tax burden. Interest income earned on most municipal bonds is exempt from federal income tax, and often from state and local taxes as well, depending on where you live and where the bond was issued.

Tax-equivalent yield is a crucial concept when considering municipal bonds. Since the interest is tax-free, the actual return is higher than the stated yield. This tax advantage makes them particularly appealing to investors in higher tax brackets, as the tax savings can significantly boost the overall return.

To effectively use municipal bonds for tax reduction, carefully consider your tax bracket and the specific bonds available. Diversification across different issuers and maturities is essential to manage risk. Consult with a financial advisor to determine the appropriate allocation of municipal bonds within your overall investment portfolio based on your risk tolerance and financial goals.

Important Note: While the interest income is typically tax-free, capital gains from selling municipal bonds before maturity are generally taxable. Understanding this nuance is crucial for effective tax planning.

Charitable Contributions as a Tax Strategy

Making charitable contributions can be a powerful tax-efficient investment strategy. For many taxpayers, donations to qualified charities are deductible from their taxable income, directly reducing their tax liability.

The amount you can deduct depends on your itemized deductions versus taking the standard deduction. If itemizing, you can deduct cash contributions up to 60% of your adjusted gross income (AGI) and donations of appreciated assets (like stocks) up to 50% of your AGI. Careful planning is crucial to maximizing this deduction.

Donating appreciated assets, rather than cash, can offer additional tax benefits. You can deduct the fair market value of the asset while avoiding capital gains taxes on the appreciation. This strategy can significantly reduce your overall tax burden and enhance the impact of your charitable giving.

It’s important to consult with a tax professional to determine the best strategy for your individual circumstances and ensure compliance with all applicable tax laws. They can help you understand the limitations and optimize your charitable contributions for maximum tax efficiency.

Using Real Estate for Tax Advantages

Real estate offers several significant tax advantages for investors. Depreciation is a key benefit, allowing you to deduct a portion of your property’s value each year, reducing your taxable income. This is particularly beneficial for rental properties.

Mortgage interest payments are often deductible, further lowering your tax liability. The specific rules surrounding deductions vary, so consulting a tax professional is crucial.

Capital gains taxes on the sale of a property can be minimized through strategies like the 1031 exchange, which allows you to defer capital gains taxes by reinvesting the proceeds into a like-kind property.

Beyond these core advantages, various other deductions are available, such as those for property taxes, repairs, and maintenance. Understanding and effectively utilizing these deductions is essential to maximizing tax efficiency in your real estate investments.

Careful planning is key to leveraging these tax benefits. Consulting with a tax advisor and real estate professional can ensure you are making informed decisions that minimize your tax burden and optimize your returns.

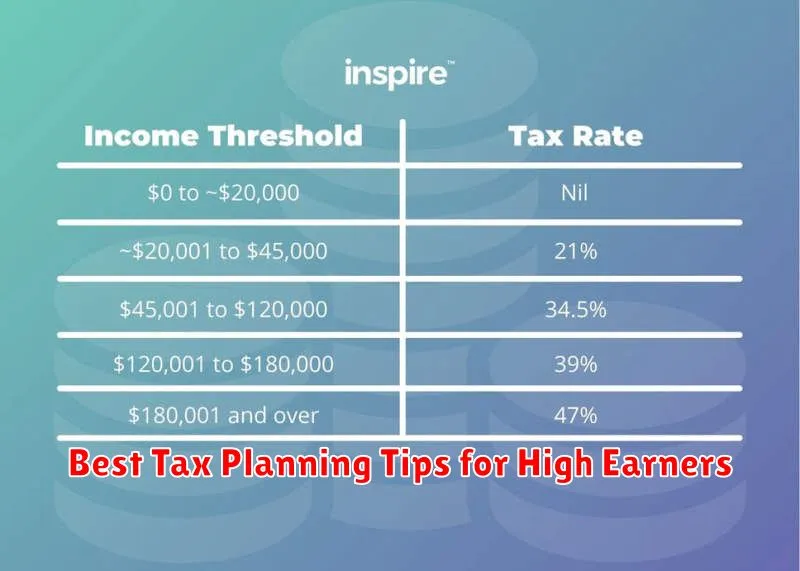

Best Tax Planning Tips for High Earners

High earners face a unique set of tax challenges. Effective tax planning is crucial to maximizing after-tax income and building wealth. Here are some key strategies:

Maximize tax-advantaged accounts: Contribute the maximum allowable amount to 401(k)s, Roth IRAs, and Health Savings Accounts (HSAs) to reduce taxable income. The tax benefits of these accounts can significantly lower your overall tax liability.

Consider tax-loss harvesting: Offset capital gains with capital losses to minimize your tax burden. This strategy involves selling losing investments to generate losses that can be used to reduce the taxes owed on profitable investments.

Explore tax-efficient investment strategies: Diversify your portfolio with investments that offer tax advantages, such as municipal bonds (for tax-free income) or investments held within tax-advantaged accounts.

Work with a qualified tax advisor: A professional can help you navigate complex tax laws and develop a personalized tax plan tailored to your specific financial situation and goals. They can identify deductions and credits you may be eligible for and help you minimize your tax liability legally and effectively.

Understand the implications of various investment vehicles: The tax treatment of different investment options varies significantly. For example, dividends and capital gains are taxed differently, impacting your overall tax efficiency. Understanding these differences is critical for optimizing your investment strategy.