Planning your retirement from full-time work can feel daunting, but with careful planning and a strategic approach, you can transition smoothly into this exciting new chapter of your life. This comprehensive guide will walk you through essential steps to ensure a successful retirement transition, covering crucial aspects like financial planning, healthcare considerations, lifestyle adjustments, and exploring fulfilling post-retirement activities. Discover how to navigate the complexities of leaving full-time employment and embrace a rewarding and fulfilling retirement.

Creating a Retirement Budget

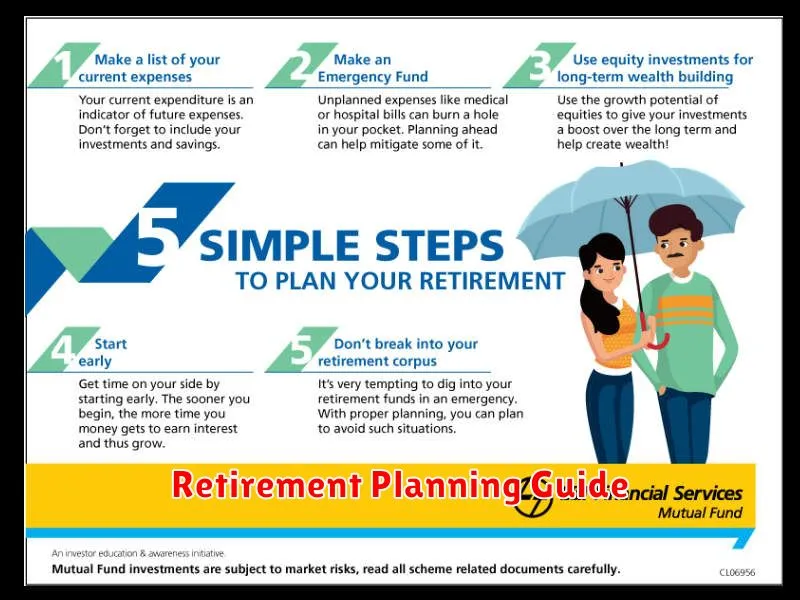

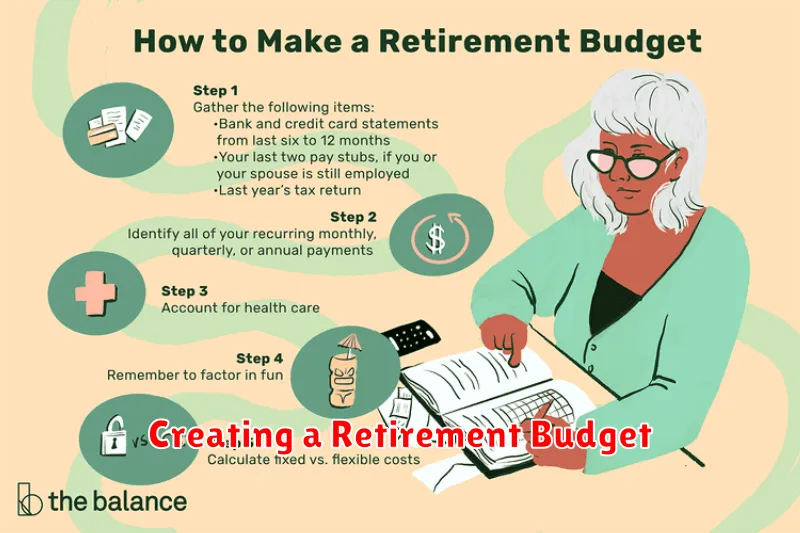

Creating a realistic retirement budget is crucial for a smooth transition from full-time work. This involves carefully assessing your expected income and expenses during retirement.

Start by estimating your monthly income. This may include Social Security benefits, pensions, investment income, and any other sources. Be conservative in your projections.

Next, meticulously list your projected expenses. Categorize them into housing, food, healthcare, transportation, utilities, entertainment, and other necessary costs. Consider potential increases in healthcare costs as you age.

Compare your projected income and expenses. If expenses exceed income, you may need to adjust your spending plan, explore additional income streams (part-time work, downsizing), or delay retirement. Regularly review and adjust your budget to account for inflation and unforeseen circumstances.

Consider using budgeting tools or seeking advice from a financial advisor to create a comprehensive and sustainable retirement budget that aligns with your financial goals and lifestyle.

Adjusting Your Lifestyle for Retirement

Transitioning to retirement requires a significant lifestyle adjustment. Financial planning is paramount; carefully review your budget and adjust spending habits to align with your reduced income stream. Consider reducing expenses in areas like housing, transportation, and entertainment.

Beyond finances, consider how your daily schedule will change. Retirement often means a significant decrease in structured time. Many retirees find it beneficial to establish a new routine that includes activities they enjoy, such as hobbies, volunteering, or travel, to maintain a sense of purpose and fulfillment.

Social interaction is crucial for mental and emotional well-being. Retirement can lead to decreased social interaction with former colleagues. Proactively cultivate new relationships and maintain existing ones through clubs, volunteer work, or social gatherings. Staying connected is key to a happy retirement.

Finally, prioritize your physical and mental health. Retirement offers an opportunity to focus on self-care. Engage in regular exercise, eat a balanced diet, and schedule regular check-ups with your doctor. Consider activities that stimulate your mind, such as learning a new language or taking up a new hobby.

How to Withdraw Money from Retirement Accounts

Transitioning to retirement requires careful planning, especially regarding your retirement account withdrawals. Understanding the rules and options available is crucial for ensuring a comfortable and sustainable retirement income.

Required Minimum Distributions (RMDs): Many retirement accounts, such as traditional IRAs and 401(k)s, mandate withdrawals after a certain age (typically 73 or 75, depending on your birth year). Failing to take your RMDs results in significant penalties. It’s vital to calculate your RMD accurately and withdraw the required amount each year.

Withdrawal Strategies: Several strategies exist for withdrawing funds, each with its own tax implications. Systematic withdrawals provide a consistent income stream, while periodic lump-sum withdrawals offer flexibility. Consult a financial advisor to determine the optimal strategy based on your individual needs and risk tolerance.

Tax Implications: Withdrawals from traditional retirement accounts are generally taxed as ordinary income. Roth IRAs, however, offer tax-free withdrawals of contributions and qualified distributions, providing significant tax advantages.

Penalties: Early withdrawals from many retirement accounts incur penalties unless specific exceptions apply (e.g., death, disability, or first-time home purchase). Understanding these exceptions and the potential penalties is crucial.

Professional Advice: Seeking guidance from a qualified financial advisor is strongly recommended. They can help you develop a personalized withdrawal plan that aligns with your financial goals and minimizes your tax liability. They can also help navigate the complexities of different account types and withdrawal rules.

Managing Healthcare Costs in Retirement

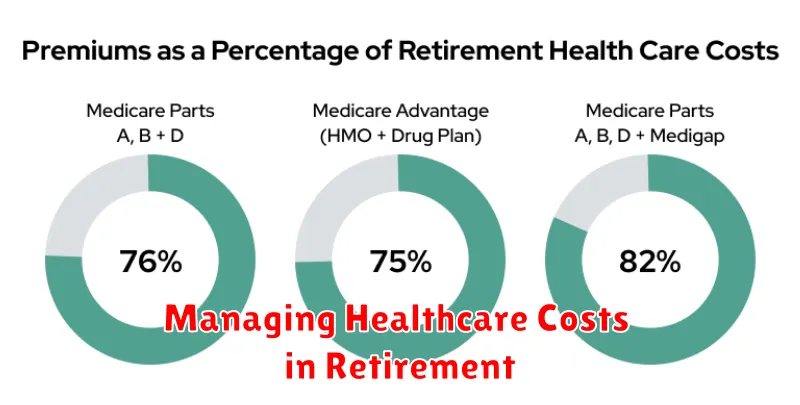

Healthcare costs are a significant concern for retirees. The loss of employer-sponsored health insurance can leave a considerable gap in coverage and budget.

Careful planning is crucial. Explore options like Medicare, supplemental insurance (Medigap), and Part D prescription drug coverage well in advance of retirement. Understanding the intricacies of each plan and its associated costs is paramount.

Budgeting is essential. Estimate your anticipated healthcare expenses, factoring in premiums, deductibles, co-pays, and prescription medications. Include a buffer for unexpected medical bills.

Health maintenance can mitigate future costs. Prioritize preventative care, regular check-ups, and a healthy lifestyle to reduce the likelihood of costly illnesses and hospitalizations.

Financial resources should be assessed. Determine how retirement savings, Social Security, and other income sources will cover healthcare expenses. Consider long-term care insurance as a potential safety net.

Comparing options is vital. Don’t hesitate to shop around for the best insurance plans and negotiate medical bills. Utilizing available resources, like Medicare advisors, can provide valuable guidance.

How to Generate Passive Income in Retirement

Transitioning to retirement often involves a significant shift in income. Generating passive income can provide crucial financial security and supplement your retirement savings.

Real estate investment trusts (REITs) offer a relatively low-effort way to generate passive income through dividends. Dividend-paying stocks in established companies also provide a consistent stream of income, although market fluctuations can impact returns.

Peer-to-peer lending platforms allow you to lend money to borrowers and earn interest. While potentially higher-yielding than traditional savings accounts, it carries a degree of risk.

High-yield savings accounts and certificates of deposit (CDs) offer lower returns but provide a safe and predictable income stream. Consider diversifying your investments to balance risk and reward.

For those with specialized skills, creating and selling online courses or ebooks can generate passive income. This requires upfront effort but can yield long-term returns.

Careful planning and diversification are key. Consult a financial advisor to create a personalized strategy that aligns with your risk tolerance and retirement goals.

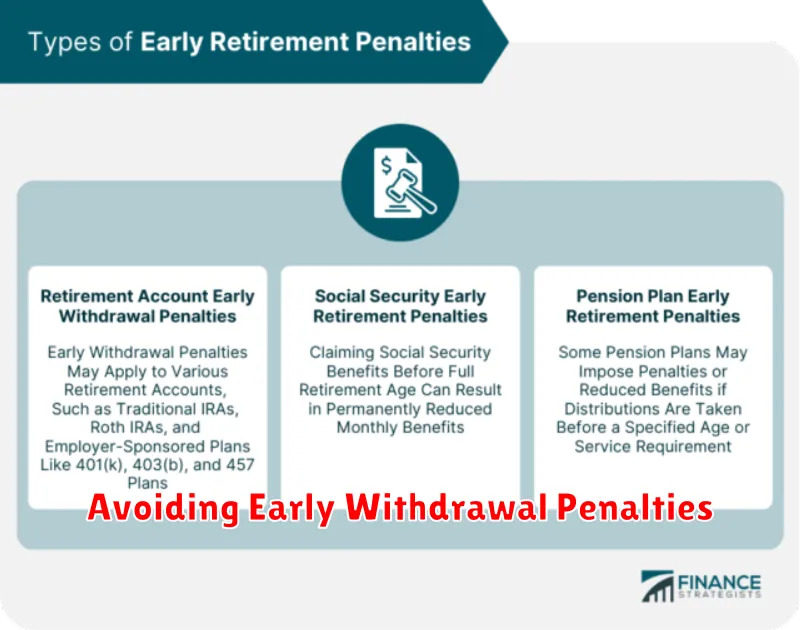

Avoiding Early Withdrawal Penalties

One of the biggest financial hurdles in transitioning to retirement is avoiding early withdrawal penalties on your retirement savings. These penalties can significantly impact your retirement income. To mitigate this risk, strategic planning is crucial.

Delaying withdrawals until you reach the age of 59 1/2 is the most effective way to prevent these penalties. This allows your investments to continue growing tax-deferred, maximizing your retirement funds.

If early access is absolutely necessary before 59 1/2, explore exceptions like qualified withdrawals for higher education or a first-time home purchase. Carefully review the specific requirements and limitations of these exceptions.

Diversifying your retirement income sources is another key strategy. Consider supplementing retirement savings with other income streams, such as part-time work, rental properties, or social security, to lessen the reliance on early withdrawals.

Consulting a financial advisor is highly recommended. They can help you create a personalized retirement plan that considers your specific circumstances and minimizes the risk of incurring early withdrawal penalties. Thorough planning and professional guidance will ensure a smoother transition into retirement.

How to Protect Your Savings from Inflation

Inflation erodes the purchasing power of your savings. To protect your nest egg during retirement, consider these strategies:

Diversify your investments: Don’t rely solely on low-yield savings accounts. Include assets that historically outperform inflation, such as stocks and real estate. A well-diversified portfolio can help mitigate the impact of inflation on your savings.

Invest in inflation-protected securities: Consider Treasury Inflation-Protected Securities (TIPS), which adjust their principal value based on inflation. This helps maintain the real value of your investment.

Increase your income streams: Explore options like part-time work or rental income to supplement your retirement income and offset the effects of inflation.

Regularly review and adjust your portfolio: Inflation and market conditions change, so it’s crucial to regularly monitor your investments and make adjustments as needed. Professional financial advice can be invaluable in this process.

Control spending: Careful budgeting and mindful spending habits can significantly extend the lifespan of your savings, helping you weather periods of high inflation.

Consider annuities: Annuities provide a guaranteed stream of income, which can be particularly helpful in protecting against the uncertainties of inflation.

Social Security Claiming Strategies

Social Security benefits are a crucial part of many retirees’ financial plans. Understanding how to maximize your benefits is key to a comfortable retirement. There are several claiming strategies, and the optimal choice depends on individual circumstances, including age, health, and spouse’s benefits.

Full Retirement Age (FRA): This is the age at which you receive 100% of your calculated Social Security benefit. Claiming before FRA results in a permanently reduced benefit, while delaying past FRA increases your monthly payment.

Early Retirement Age: You can begin collecting benefits as early as age 62. However, claiming early significantly reduces your monthly payment for life. This strategy might be considered if you have limited savings or anticipate significant health issues.

Delayed Retirement: Delaying benefits beyond FRA increases your monthly payment. This is advantageous if you are in good health and expect to live a long life. The maximum increase is reached at age 70.

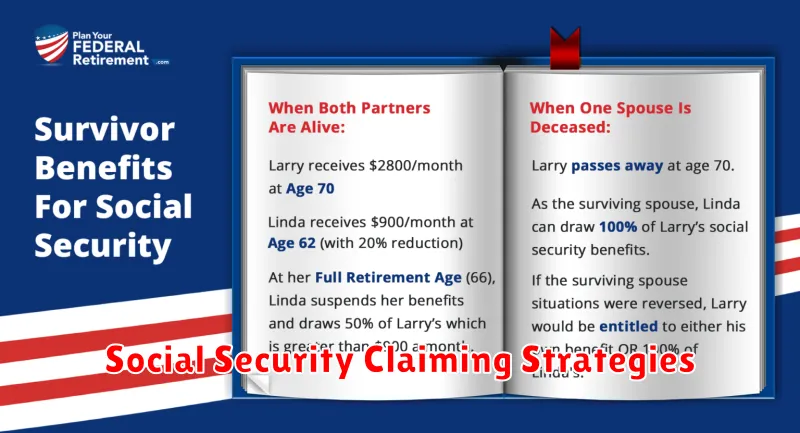

Spousal Benefits: If you are married, you may be eligible for spousal benefits based on your spouse’s work history. This can be beneficial if one spouse has significantly higher earnings than the other.

Survivor Benefits: If your spouse passes away, you may be eligible for survivor benefits. The amount you receive depends on your spouse’s benefit amount and your age at the time of their death.

Careful planning is essential. Consider consulting a financial advisor to determine the best claiming strategy for your unique situation. They can help you analyze your individual circumstances and project the long-term implications of various claiming options. Don’t underestimate the importance of professional guidance in maximizing your Social Security benefits.