Navigating market volatility can be daunting, especially when it comes to managing your wealth. This comprehensive guide will equip you with the strategies and knowledge you need to protect and grow your investments during periods of uncertainty. Learn how to mitigate risk, optimize your portfolio, and maintain a long-term financial plan, even amidst market fluctuations and economic downturns. Discover practical techniques for managing wealth and achieving financial stability, regardless of market conditions.

What Causes Market Volatility?

Market volatility, characterized by significant price fluctuations in assets like stocks and bonds, stems from a confluence of factors. Economic data releases, such as unexpectedly high inflation or weak employment numbers, can trigger immediate reactions. Geopolitical events, including wars, political instability, and international tensions, introduce substantial uncertainty, impacting investor sentiment and market confidence.

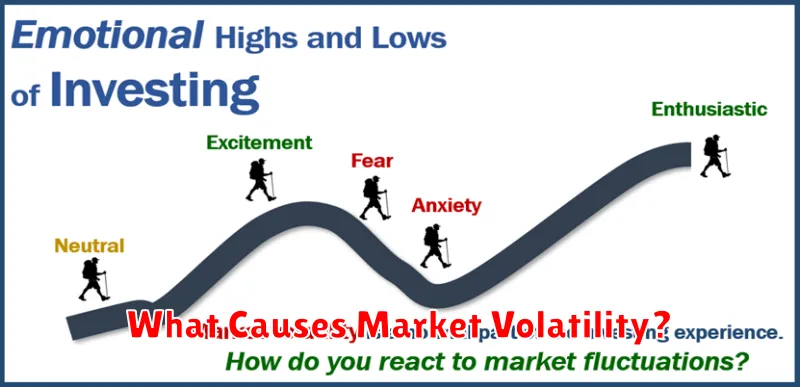

Unexpected company news, such as earnings surprises or significant changes in leadership, can significantly impact individual stock prices and ripple throughout related sectors. Changes in interest rates set by central banks influence borrowing costs and investment strategies, leading to shifts in market valuations. Finally, investor psychology and market sentiment play a crucial role; fear and panic selling can amplify existing price swings, while periods of optimism can drive asset prices upwards, sometimes irrationally.

Understanding the interplay of these elements is key to managing wealth during volatile periods. While predicting precise market movements is impossible, recognizing these drivers of volatility allows for informed decision-making and the development of robust investment strategies that can withstand market fluctuations.

How to Stay Calm During Market Drops

Market drops are a normal part of the investment cycle. Panic selling is often the worst reaction. Instead, focus on your long-term financial plan. Sticking to your investment strategy, even during periods of volatility, is crucial for long-term success.

Review your risk tolerance. Understand your comfort level with market fluctuations. If your investments are aligned with your risk profile, a temporary downturn shouldn’t cause undue alarm.

Avoid emotional decision-making. Market fluctuations are frequently driven by short-term factors. Making impulsive decisions based on fear can lead to significant losses. Instead, rely on your research and analysis.

Maintain a diversified portfolio. Diversification helps mitigate risk by spreading investments across different asset classes. This reduces the impact of any single asset’s underperformance.

Focus on the big picture. Remember your long-term financial goals. Market downturns are temporary setbacks, not a reflection of your overall financial health. Patience and discipline are key during these periods.

Consider seeking advice from a financial advisor. A professional can provide personalized guidance and help you navigate market volatility effectively.

Diversifying Assets to Minimize Risk

Market volatility presents a significant challenge to wealth management. A key strategy to mitigate risk is diversification of assets. This involves spreading investments across different asset classes, reducing the impact of poor performance in any single area.

Diversification isn’t simply about owning many different stocks. It encompasses a broader approach. Consider allocating your portfolio across various asset classes such as stocks (equities), bonds (fixed income), real estate, commodities (e.g., gold, oil), and alternative investments (e.g., private equity, hedge funds). The specific allocation will depend on individual risk tolerance and financial goals.

Within each asset class, further diversification is crucial. For instance, within stocks, you might invest in different sectors (technology, healthcare, etc.), market capitalizations (large-cap, small-cap), and geographical regions. This reduces reliance on any single company or sector, minimizing losses if one performs poorly.

Rebalancing your portfolio periodically is essential to maintain your desired asset allocation. As market conditions change, some asset classes may outperform others, causing your portfolio to drift from its target. Rebalancing involves selling some of the better-performing assets and buying more of the underperforming ones to restore the original allocation.

Effective diversification requires careful planning and ongoing monitoring. While it doesn’t eliminate risk entirely, it significantly reduces the impact of market fluctuations, providing a more resilient investment strategy during periods of volatility.

Best Safe-Haven Investments

During periods of market volatility, preserving capital becomes paramount. Safe-haven investments are assets that tend to hold their value or even appreciate when other markets decline. These provide a degree of protection against economic uncertainty.

Gold is a classic safe haven, historically acting as a hedge against inflation and currency devaluation. Its inherent value and limited supply make it attractive during times of turmoil.

Government bonds, particularly those issued by stable, developed nations, are another solid option. These offer a relatively predictable return and are considered less risky than equities.

Swiss francs and US dollars are often sought-after currencies during times of global instability. Their stability makes them attractive to investors seeking to protect their assets from currency fluctuations.

Real estate, particularly in stable markets, can also be a reliable safe-haven asset. While not as liquid as other options, it often provides a hedge against inflation and offers potential for long-term appreciation.

It’s crucial to remember that no investment is entirely risk-free. Diversification across various safe-haven assets is key to mitigating risk and building a resilient portfolio during times of market uncertainty. Consult a financial advisor for personalized guidance.

How to Adjust Your Portfolio During Economic Uncertainty

Economic uncertainty necessitates a proactive approach to portfolio management. Diversification remains crucial; a well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) can mitigate risk.

During times of volatility, consider increasing your allocation to lower-risk assets like government bonds or high-quality corporate bonds. These tend to be less susceptible to market swings than equities.

Rebalancing your portfolio is key. If certain asset classes have significantly outperformed others, rebalancing back to your target asset allocation can help lock in profits and reduce exposure to over-concentrated positions.

Review your risk tolerance. Economic uncertainty may prompt you to reassess your risk tolerance and adjust your portfolio accordingly. If your risk tolerance has decreased, you may want to shift towards a more conservative strategy.

Avoid impulsive decisions driven by fear or panic. Market volatility is a normal part of investing. Making rash decisions based on short-term market fluctuations can lead to long-term losses. Instead, focus on your long-term financial goals and maintain a disciplined investment strategy.

Consider consulting with a financial advisor. A professional can provide personalized guidance based on your individual circumstances and risk profile, helping you navigate the complexities of economic uncertainty and adjust your portfolio effectively.

Using Dollar-Cost Averaging to Reduce Market Risk

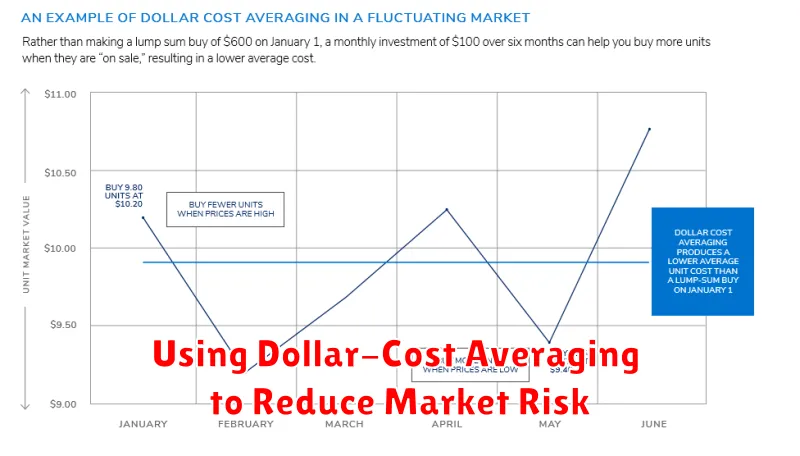

Market volatility is a significant concern for wealth management. Dollar-cost averaging (DCA) is a valuable strategy to mitigate this risk. DCA involves investing a fixed dollar amount at regular intervals, regardless of market fluctuations.

The benefit of DCA lies in its ability to reduce the impact of buying high and selling low. During market downturns, you acquire more shares at lower prices. Conversely, during market upturns, you buy fewer shares at higher prices. This averages out your purchase price over time, lessening the overall impact of short-term market swings.

While DCA doesn’t guarantee profits, it significantly reduces the risk associated with attempting to time the market. It’s a disciplined approach that promotes consistent investing, rather than emotional reactions to market fluctuations. This makes it a suitable strategy for long-term investors seeking to minimize volatility’s impact on their portfolio.

It’s important to note that while DCA reduces risk, it may also mean missing out on potentially higher returns if the market experiences a sustained upward trend. Careful consideration of your risk tolerance and investment goals is crucial before implementing any investment strategy, including DCA.

Creating a Long-Term Wealth Strategy

Market volatility is inevitable, making a long-term wealth strategy crucial for navigating economic uncertainty. This involves focusing on your financial goals and building a diversified portfolio that aligns with your risk tolerance and time horizon.

A key component is diversification. Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of any single market downturn. This helps mitigate risk and potentially increase returns over the long term.

Regular contributions to your investments, even during market dips, are vital. Dollar-cost averaging helps mitigate the risk of investing a lump sum at a market peak. This strategy involves investing a fixed amount at regular intervals, regardless of market fluctuations.

Rebalancing your portfolio periodically is also important. This involves adjusting your asset allocation to maintain your desired risk level. When one asset class outperforms others, rebalancing helps to capture profits while maintaining a balanced approach.

Finally, developing a long-term perspective is paramount. Avoid making impulsive decisions based on short-term market fluctuations. Staying disciplined and focused on your long-term financial goals is key to building and preserving wealth.