Planning for a comfortable and secure retirement is crucial, and it requires diligent financial preparation. This comprehensive guide, “How to Prepare Financially for Retirement,” will equip you with the essential knowledge and strategies to navigate the complexities of retirement planning, including saving, investing, and managing your retirement accounts. Learn how to effectively estimate your retirement needs, build a robust retirement portfolio, and ensure a financially sound retirement lifestyle.

When Should You Start Saving for Retirement?

The ideal time to begin saving for retirement is as early as possible. The power of compound interest allows your investments to grow exponentially over time, making even small contributions early on significantly impactful.

While starting in your twenties is optimal, it’s never too late to begin. Even starting in your thirties or forties can still yield substantial benefits, though you may need to contribute larger amounts or consider adjusting your retirement goals.

Your specific circumstances should influence your decision. Factors like current income, existing debts, and retirement goals should all be considered. It’s advisable to consult with a financial advisor to create a personalized retirement savings plan.

Key takeaway: The sooner you start saving for retirement, the better. However, initiating a savings plan at any age is crucial for securing a comfortable financial future.

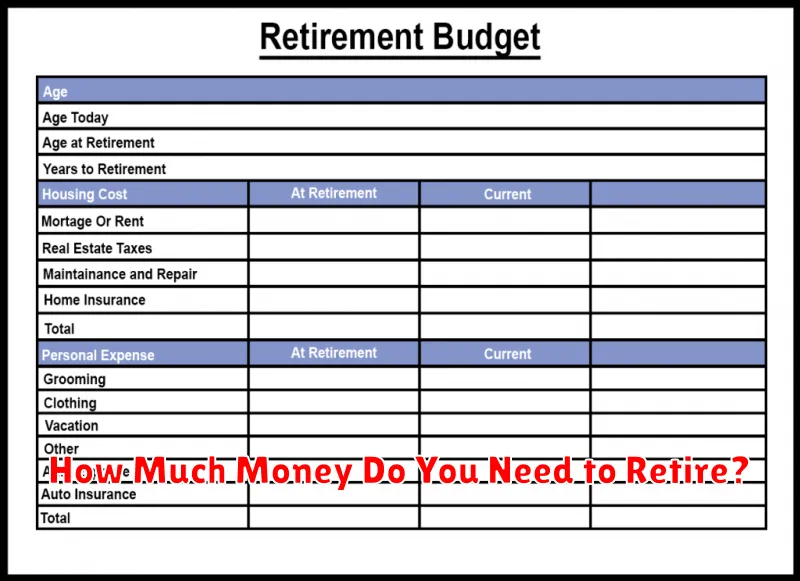

How Much Money Do You Need to Retire?

Determining how much money you need for retirement depends on several key factors. These include your desired lifestyle, current expenses, expected lifespan, and health care costs.

A common rule of thumb is the 80% rule, suggesting you’ll need 80% of your pre-retirement income to maintain your lifestyle. However, this is a generalization and may not accurately reflect individual circumstances.

Consider these factors when estimating your retirement needs: your current spending habits, anticipated inflation, potential healthcare expenses (which can be substantial), and whether you plan to continue working part-time.

Financial planning tools and consultations with financial advisors can provide personalized estimates based on your unique situation. These tools can help you project your future expenses and determine the necessary savings to meet your retirement goals.

Ultimately, the amount you need is highly individualized and requires careful planning and consideration of your specific financial circumstances and retirement aspirations.

Different Types of Retirement Accounts

Planning for retirement involves understanding and utilizing various retirement accounts. These accounts offer tax advantages and contribute to building your retirement nest egg. Choosing the right account depends on your income, risk tolerance, and retirement goals.

401(k) plans are employer-sponsored retirement savings plans. Contributions are often tax-deferred, meaning you don’t pay taxes on the money until retirement. Some employers offer matching contributions, essentially providing free money towards your retirement.

Traditional IRAs (Individual Retirement Accounts) allow for pre-tax contributions, reducing your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income.

Roth IRAs, in contrast, involve after-tax contributions. However, withdrawals in retirement are tax-free, offering a significant advantage for those expecting to be in a higher tax bracket during retirement.

SEP IRAs (Simplified Employee Pension plans) are retirement plans for self-employed individuals and small business owners. Contributions are tax-deductible, and earnings grow tax-deferred.

403(b) plans are similar to 401(k) plans but are specifically for employees of non-profit organizations, such as schools and hospitals.

Careful consideration of each account’s features, contribution limits, and tax implications is crucial for effective retirement planning. Consulting a financial advisor can help determine the best strategy for your individual circumstances.

The Best Investment Strategies for Retirement

Planning for retirement requires a thoughtful approach to investing. Diversification is key to mitigating risk. A balanced portfolio should include a mix of asset classes, such as stocks, bonds, and real estate, to spread risk across various market sectors.

Stocks, particularly those of established companies, offer the potential for higher returns over the long term but come with greater volatility. Bonds, on the other hand, provide more stability and lower risk, offering a steady stream of income.

Real estate can be a valuable addition, offering both potential appreciation and rental income. However, it requires more active management compared to other investments. Consider retirement accounts, such as 401(k)s and IRAs, which offer tax advantages and help accelerate savings growth.

Index funds and exchange-traded funds (ETFs) provide broad market exposure at a relatively low cost, making them attractive options for long-term retirement investing. Regular contributions are crucial; the earlier you start, the more time your investments have to grow through compounding.

It’s important to regularly review and rebalance your portfolio to ensure it still aligns with your risk tolerance and retirement goals. Consulting with a financial advisor can provide personalized guidance and help you tailor your investment strategy to your specific needs and circumstances.

Understanding Social Security Benefits

Social Security is a vital component of retirement planning in the United States. It’s a federal program providing retirement, disability, and survivor benefits to eligible individuals.

To understand your potential benefits, you need to know your full retirement age (FRA). This is the age at which you’re entitled to receive your full retirement benefit. Claiming benefits before your FRA results in a permanently reduced monthly payment, while delaying benefits beyond your FRA increases them.

Your benefit amount depends on your earnings history. The Social Security Administration (SSA) considers your highest 35 years of earnings when calculating your benefit. Higher earnings generally translate to higher benefits.

It’s crucial to contact the SSA to obtain a personalized estimate of your future benefits. This allows you to plan for your retirement more effectively. The SSA provides online tools and resources to help you understand your benefits and plan accordingly.

Understanding your Social Security benefits is crucial to creating a comprehensive retirement plan. It’s a significant source of income for many retirees, and understanding how it works can significantly impact your financial security in retirement.

How Inflation Affects Your Retirement Savings

Inflation erodes the purchasing power of your savings over time. This means that the value of your retirement nest egg will be lower in the future than it is today if inflation is not considered.

For example, if inflation averages 3% annually, an item costing $100 today will cost approximately $134.4 in 10 years. This means your retirement savings need to grow faster than inflation to maintain your living standard.

The impact of inflation is particularly significant for retirees who rely on a fixed income stream, such as a pension or annuity. Their purchasing power will gradually decrease as prices rise unless their income is adjusted for inflation.

To mitigate the effects of inflation, consider investing in assets that have historically outpaced inflation, such as stocks and real estate. Diversification of your portfolio can also help protect your savings from inflation’s effects.

Regularly reviewing and adjusting your retirement savings plan is crucial to ensure you’re on track to meet your financial goals in the face of inflation. Professional financial advice can help you develop a strategy that accounts for inflation and ensures a comfortable retirement.

Creating a Post-Retirement Income Plan

A robust post-retirement income plan is crucial for maintaining your desired lifestyle after leaving the workforce. It should account for your anticipated expenses, healthcare costs, and desired level of financial security.

Begin by estimating your retirement expenses. Consider housing, food, transportation, healthcare, entertainment, and travel. Factor in potential inflation over your retirement years.

Next, determine your income sources. This could include Social Security benefits, pensions, 401(k)s, IRAs, and other investments. Project how much income each source will provide annually.

Bridge the gap between your projected expenses and income. If your income is insufficient, explore options like downsizing your home, delaying retirement, or increasing your savings and investments before retirement.

Diversify your investments to manage risk. A mix of stocks, bonds, and other assets can help protect against market fluctuations. Regularly review and adjust your portfolio as needed.

Consider working part-time during retirement to supplement your income and maintain an active lifestyle. This can also provide a sense of purpose and social interaction.

Finally, seek professional financial advice. A financial advisor can help you create a personalized plan, taking into account your individual circumstances and goals. They can also assist with investment management and tax planning.

Avoiding Common Retirement Planning Mistakes

Many individuals make critical errors when planning for retirement, jeopardizing their financial security. Failing to start early is a significant mistake. The power of compound interest means that starting even small contributions early significantly increases your retirement nest egg.

Another common error is underestimating retirement expenses. Healthcare costs, for example, can be substantial in retirement. A thorough budget accounting for all potential expenditures is crucial. Ignoring inflation is equally damaging. Retirement savings need to account for the projected rise in prices over time to maintain their purchasing power.

Not diversifying investments increases risk. A well-diversified portfolio spreads risk across different asset classes, mitigating potential losses from any single investment. Lack of a written plan is also detrimental. A detailed retirement plan outlining goals, strategies, and risk tolerance ensures a clear roadmap toward financial security. Finally, failing to regularly review and adjust the plan in response to life changes, market fluctuations, and legislative adjustments can hinder progress significantly.

By avoiding these common pitfalls, individuals can significantly improve their chances of a comfortable and financially secure retirement.