Creating a successful investment strategy requires careful planning and execution. This comprehensive guide will walk you through the essential steps to building a robust portfolio aligned with your financial goals. Learn how to assess your risk tolerance, diversify your investments, select appropriate asset classes, and monitor your portfolio performance for optimal returns. Discover proven strategies for long-term wealth creation and navigate the complexities of the investment market with confidence.

Defining Your Investment Goals

Before embarking on any investment journey, clearly defining your financial goals is paramount. This involves identifying your investment objectives – are you saving for retirement, a down payment on a house, your children’s education, or something else? Be specific; instead of “retirement,” specify a desired retirement income or nest egg amount.

Next, determine your time horizon. How long do you have until you need the money? A longer time horizon generally allows for more aggressive investment strategies with higher risk tolerance, while shorter timelines often necessitate more conservative approaches. Consider the risk tolerance associated with each goal; are you comfortable with potential losses to achieve higher potential returns, or do you prefer a lower-risk, slower-growth strategy?

Finally, quantify your financial resources. How much capital can you realistically allocate to investing? This amount will significantly influence the types of investments suitable for your goals. Consider establishing a realistic budget and sticking to it. Remember that achieving your goals may require consistent discipline and patience.

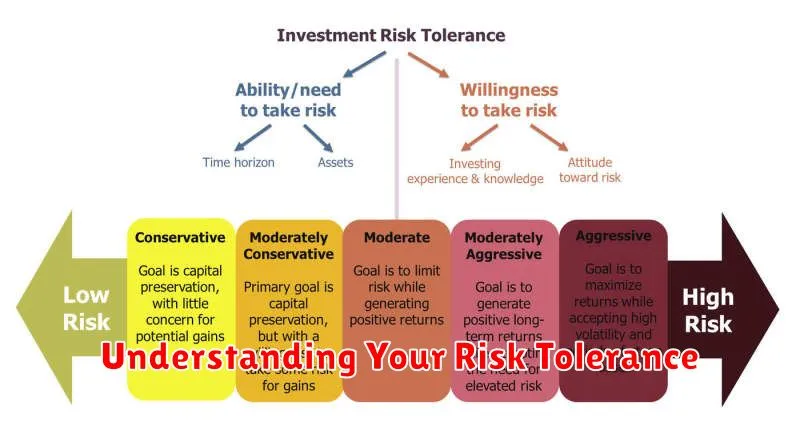

Understanding Your Risk Tolerance

Before embarking on any investment strategy, understanding your risk tolerance is paramount. This refers to your comfort level with the possibility of losing money in pursuit of higher returns. It’s a crucial factor influencing your investment choices and overall portfolio composition.

Risk tolerance isn’t static; it varies based on individual factors like age, financial goals, and personality. A younger investor with a longer time horizon might tolerate higher risk, aiming for potentially greater returns. Conversely, an investor nearing retirement might prioritize capital preservation and choose less risky options.

Several methods exist for assessing your risk tolerance. Consider using online questionnaires, consulting a financial advisor, or reflecting on your past investment behaviors. Honestly evaluating your feelings about potential losses is critical. Understanding your risk tolerance empowers you to make informed decisions that align with your financial situation and goals.

Remember, a successful investment strategy balances your desired returns with your acceptable level of risk. A strategy too aggressive for your tolerance can lead to anxiety and potentially poor investment decisions. Conversely, a strategy too conservative might fail to meet your long-term financial objectives. Finding the right balance is key.

Types of Investment Strategies

Choosing the right investment strategy is crucial for achieving your financial goals. Several approaches cater to different risk tolerances and time horizons. Active investing involves actively managing a portfolio, attempting to outperform market benchmarks through frequent buying and selling. This requires significant time and expertise.

Conversely, passive investing emphasizes buying and holding a diversified portfolio, mirroring a market index like the S&P 500. This approach minimizes transaction costs and relies on the long-term growth of the market. It generally requires less time and expertise.

Value investing focuses on identifying undervalued assets – companies trading below their intrinsic worth – and holding them until the market recognizes their true value. This strategy requires in-depth fundamental analysis.

Growth investing prioritizes companies with high growth potential, even if currently trading at a premium. This strategy involves identifying companies expected to experience significant earnings growth in the future.

Income investing aims to generate a steady stream of income from investments like dividends or interest payments. This strategy is often favored by investors seeking regular cash flow.

Index fund investing is a passive strategy mirroring a specific market index, offering broad diversification and low costs. This provides exposure to the overall market performance.

Ultimately, the best investment strategy depends on your individual financial situation, risk tolerance, investment goals, and time horizon. Consider seeking professional advice to determine the most suitable approach for you.

Short-Term vs Long-Term Investment

A successful investment strategy hinges on understanding the difference between short-term and long-term investments. Short-term investments typically involve assets held for less than a year, aiming for quick profits. Examples include high-yield savings accounts, money market funds, and short-term bonds. These options generally offer lower returns but present less risk.

In contrast, long-term investments involve assets held for several years, even decades. The goal is to achieve substantial growth over time. Stocks, real estate, and index funds are common examples. While potentially offering higher returns, long-term investments are subject to greater market fluctuations and require more patience.

The choice between short-term and long-term investments depends on your financial goals and risk tolerance. Short-term investments are suitable for immediate needs or preserving capital, while long-term investments are better suited for building wealth over the long haul. A balanced portfolio, incorporating both short-term and long-term strategies, is often recommended for optimal results.

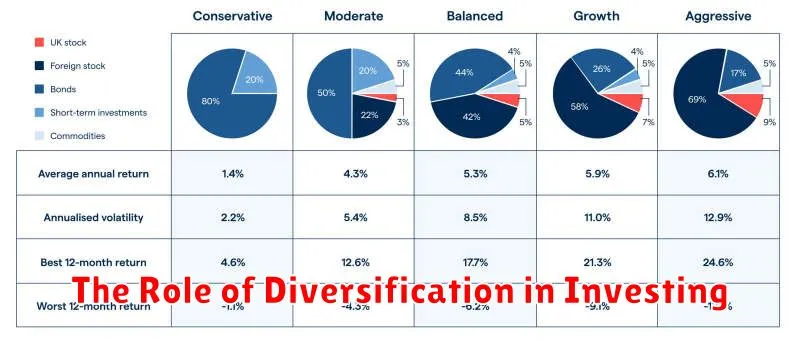

The Role of Diversification in Investing

Diversification is a cornerstone of any successful investment strategy. It involves spreading your investments across various asset classes, sectors, and geographies to reduce risk. Risk reduction is key; by not putting all your eggs in one basket, you mitigate the impact of poor performance in any single investment.

Different asset classes, such as stocks, bonds, and real estate, tend to behave differently in the market. During economic downturns, for example, some assets might perform better than others. This means a diversified portfolio is less likely to suffer significant losses overall.

Sector diversification is also crucial. Investing solely in technology, for instance, exposes you to the specific risks of that sector. Spreading investments across various sectors (e.g., healthcare, consumer goods, energy) lessens this risk. Similarly, geographic diversification reduces reliance on a single economy’s performance.

While diversification doesn’t guarantee profits, it significantly improves the chances of achieving your long-term investment goals by mitigating potential losses and increasing the likelihood of consistent returns. The level of diversification depends on individual risk tolerance and investment objectives. Professional financial advice can be invaluable in determining the appropriate diversification strategy for your circumstances.

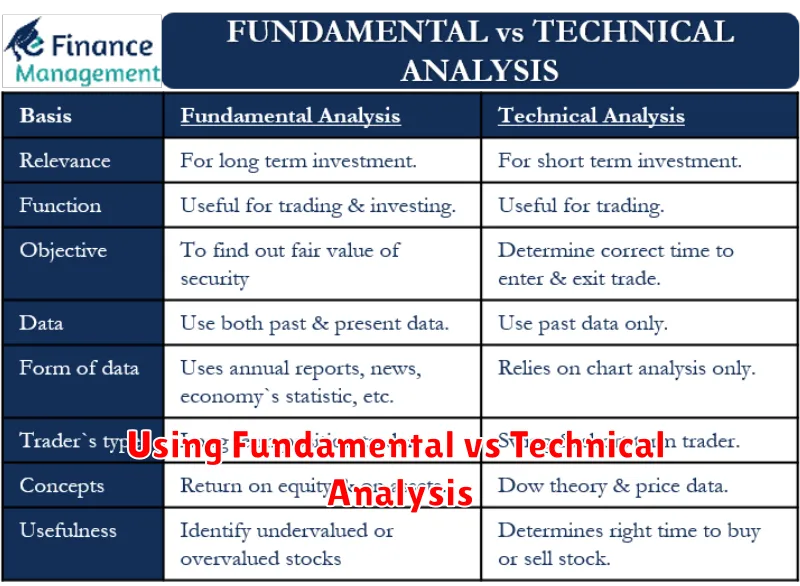

Using Fundamental vs Technical Analysis

Creating a successful investment strategy often involves leveraging both fundamental and technical analysis, though the emphasis on each can vary depending on your investment goals and time horizon.

Fundamental analysis focuses on evaluating the intrinsic value of an asset. This involves examining a company’s financial statements, management quality, competitive landscape, and overall economic conditions to determine whether an asset is undervalued or overvalued in the market. Investors using this approach are generally focused on long-term growth.

Technical analysis, conversely, focuses on past market data like price and volume to predict future price movements. This approach uses charts, indicators, and patterns to identify trends and potential trading opportunities. Technical analysts are often interested in shorter-term trades and are less concerned with the fundamental value of the asset itself.

A balanced approach typically combines both methods. Fundamental analysis can help identify promising investments, while technical analysis can help determine optimal entry and exit points. For example, a fundamental analyst might identify a fundamentally sound company, while a technical analyst could pinpoint the best time to buy or sell its stock based on chart patterns and indicators. The optimal weighting of each approach depends on individual investor preferences and risk tolerance.

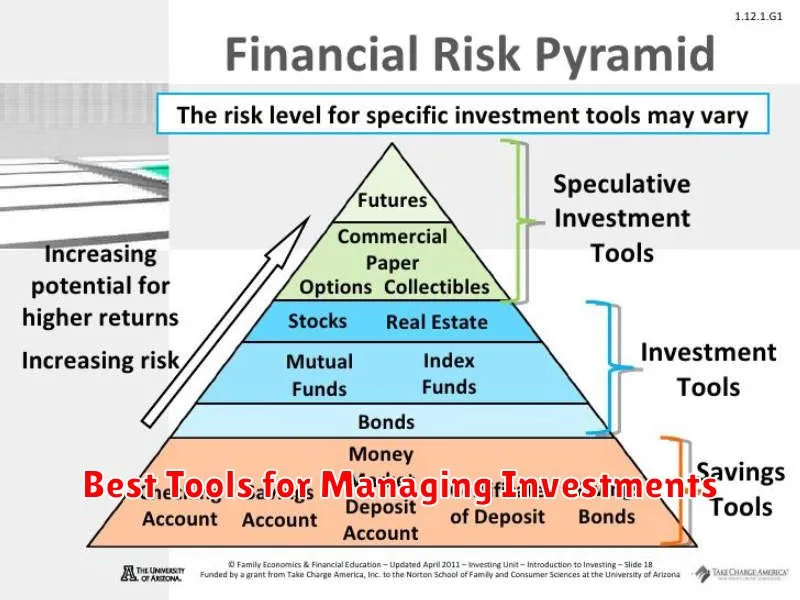

Best Tools for Managing Investments

Effectively managing your investments requires the right tools. Spreadsheets remain a fundamental tool for tracking portfolio performance, calculating returns, and analyzing asset allocation. Their flexibility allows for customization to individual needs.

Investment management software offers more sophisticated features. These platforms often provide portfolio tracking, automated reporting, tax optimization tools, and even research capabilities. Examples include Personal Capital, Quicken Premier, and others tailored to specific investment strategies.

Brokerage platforms often integrate investment management tools directly into their interfaces. Many offer features such as portfolio analysis, research reports, and direct access to trading. The level of sophistication varies across platforms.

Financial planning software can provide a broader perspective, integrating investment management with other financial aspects such as budgeting, retirement planning, and tax strategies. This holistic approach can be valuable for long-term financial success.

Finally, consider leveraging financial advisors. While not a tool in the traditional sense, their expertise and personalized guidance can significantly enhance your investment management efforts. They offer valuable insights and support beyond the capabilities of software alone. The choice of tool depends on your individual needs, investment complexity, and technical proficiency. A combination of tools may be the most effective approach.

Common Mistakes to Avoid in Investing

One of the most prevalent errors is emotional investing. Decisions driven by fear or greed, reacting to short-term market fluctuations, often lead to poor outcomes. Avoid impulsive buys or sells based on daily news.

Lack of diversification is another significant pitfall. Concentrating investments in a single asset class or a few specific stocks exposes you to excessive risk. A well-diversified portfolio spreads risk across different asset classes, minimizing potential losses.

Ignoring fees and expenses can significantly erode investment returns over time. High management fees, trading commissions, and other charges can eat into your profits. Carefully compare the cost structures of different investment options.

Failing to have a clear investment plan is a recipe for disaster. Without defined goals, a suitable timeframe, and a risk tolerance assessment, your investments will lack direction. Create a detailed plan outlining your objectives and strategies.

Insufficient research and due diligence are common causes of investment failure. Thoroughly investigate any investment before committing your funds. Understand the underlying risks and potential rewards.

Finally, chasing high returns without considering the associated risks is a dangerous approach. High-risk investments are not inherently bad, but they should only be part of a diversified portfolio, and only after careful consideration of your risk profile.